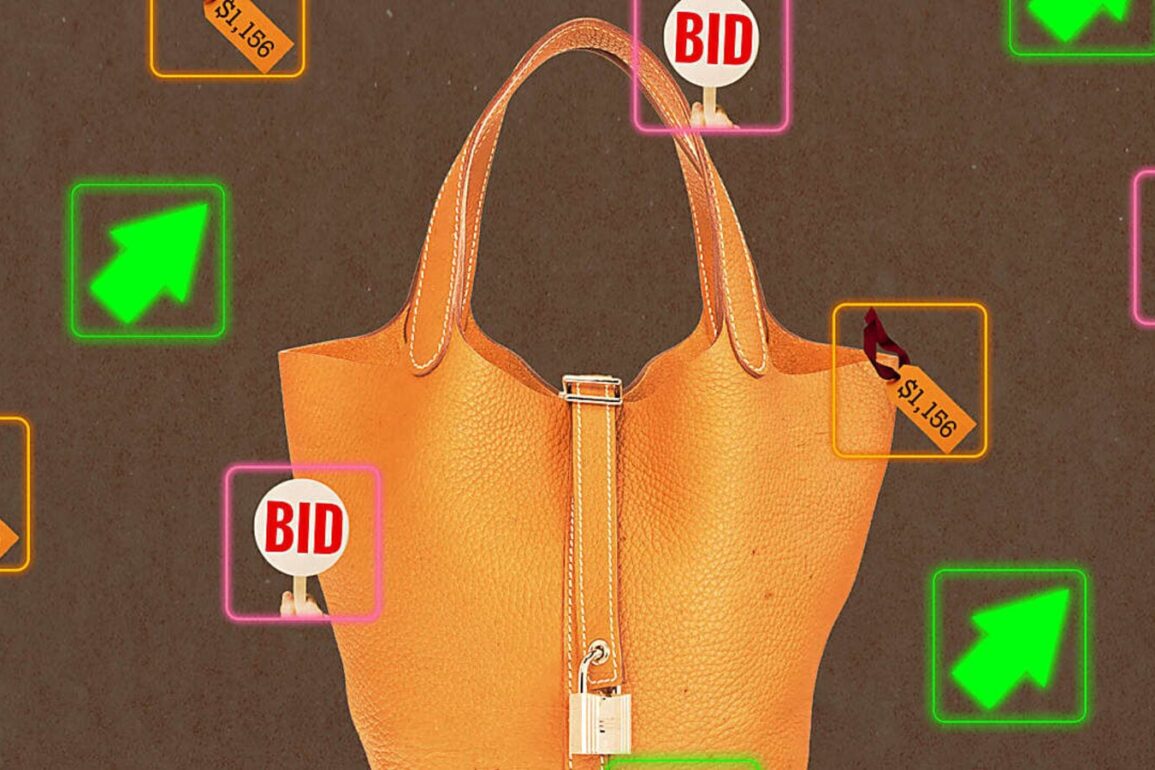

Auction houses like Christie’s and Sotheby’s have grown their handbag businesses in the past decade, as demand for name brands like the Hermès Birkin and Chanel’s flap bag has increased. Thanks to social media, young people are more interested in and knowledgeable about the accessories market than ever before, especially the ins and outs of collecting. Some even tout the Birkin as a better investment than gold.

At the same time, prices on the primary market are skyrocketing for many brands, and so-called “super-fakes” are plaguing resale sites, making consumers nervous, even if they have the budget to spend. In this environment, auction houses—known for their trade in blue-chip artwork and antiquities—are not just places to find investments. They’re also trusted places to find (relatively) good deals.

“There are bags that are for a very serious collector, but we also have many pieces that are starting at $100,” said Rachel Koffsky, international head of handbags and accessories at Christie’s. Koffsky puts together the handbag auctions for the house, appraising bags from clients and judging the bag’s condition on a scale of 1 to 6 with her team.

(Fingernail-sized scratches on the leather, or signs of wear on the interior of the bag that can be seen with a black light will both knock down an otherwise pristine bag to a 1.5). Currently, her team is preparing for an auction starting on Sept. 4.

The client base has also broadened, a phenomenon Koffsky credits to social media. “There are collectors at all different ages, price points,” she says. “In the past five years we went from 29% of our bidders [and] buyers being millennials to 42%, and with Gen Z it went from 1.5% to 3%. It’s not a huge percentage but it has doubled in the past five years.”

Koffsky says that clients are much more knowledgeable about the specifics of handbags today than they were a decade ago. As luxury handbags have been touted as investments, and social-media platforms like TikTok have lifted the veil from the shopping experiences previously limited to the 1%, more people have become interested in buying handbags as an investment.

“Ten years ago when I started working at Christie’s, I spent so much time educating people about what is a Birkin, what is a Kelly, and today clients come in and they say, ‘I’m looking for a rose azalee Kelly Danse.’” (Hermès speak for a pouch with an extra-long strap that can convert it into a backpack, belt-bag or crossbody, in a highly desirable shade inspired by azaleas.)

The most sought-after style—the one that sets the most records—is a Himalayan Hermès bag. In November 2020, a Himalayan Kelly 25 (a top-handle bag made of crocodile leather that resembles snow-capped peaks) became the most expensive handbag sold at auction when it sold for HK$3,375,000 at Christie’s. It lost the title by November 2021, when Christie’s sold a Himalayan Kelly 28 for HK$4,000,000.

Lucy Bishop, a handbag specialist for Sotheby’s New York, likened the luxury market to a pyramid, with Hermès at the top and Chanel in second. The most popular bags are Hermès’s Birkin and Kelly bags and Chanel’s flap bag. All three come in a range of colors and textiles. However, buying one on the primary market is not always easy.

In March, Hermès was sued in California for allegedly violating antitrust law by requiring customers to buy other goods before they’re given the chance to purchase a Birkin. The less desirable purses are referred to as “non-quota bags” in the handbag-collecting community online. Chanel has also been criticized for its price increases.

In March 2024, the price of a medium Chanel Classic flap bag increased to $10,800, compared with $4,900 in 2016. In a recent Christie’s sale, a large accordion flap bag from the cruise 2015 collection sold for $1,638.

Price increases and gatekeeping are two reasons people go to auction houses for staple bags, whether they consider themselves collectors or not.

“Once upon a time, auctions were reserved for a very small sector of the luxury population,” said Monika Arora, the founder of the website PurseBop. “Auctions and handbag auctions have become much more relatable than they were many years ago. It’s a form of e-commerce shopping in a way now, and there are great deals to be found.”

“Deal” is a relative term. Kirsty Merrett, who has been collecting handbags for around 15 years and is based in England, has found Chanel shoulder bags for £1,000, and a Fendi purse for £150 at auction. “I know that some people are like, ‘Oh, my God, I would never spend that much,’ but for a Chanel bag that is pretty good,” she said.

Auction houses charge a buyer’s premium, often between 20% and 30%, as well as tax and shipping. So a $1,000 hammer price (the price an auctioneer yells “sold!” for) would be $1,200 with a 20% buyer’s premium. Die-hard collectors and fanatics have also long found steals at estate sales and eBay—where they don’t have to factor in hammer-prices—but shopping at a major auction house lends a sense of security. “I tell people that I love buying at auction—I trust it, it’s so fun—but beware of the buyer’s premium,” Merrett said.

Gina Miller, a media executive in Texas, enjoys browsing auction sites for bags and scarves in her free time. She found a Goyard crossbody bag for $1,156 including tax and buyer’s premium, cheaper than the $1,310 retail price.

“These houses have prestigious names and deal with millions of dollars of artwork, but I’ve found that every single auction house is happy to take your money,” Miller said. “The prices are not that high, so for a shopper who might not have the funds to pay full retail, they could actually get into the luxury designer game this way. You can do it in your T-shirts and shorts at home; you don’t have to be dressed up. I’ve done it in my PJs.”

Having the seal of authenticity from an auction house is an added comfort for some shoppers, as each piece is reviewed by a team of experts. “For me, I never have to worry about fakes,” Merrett said. “I wanted to buy pre-loved, because I wanted a price I was really happy with, but I wasn’t confident shopping anywhere, which is why I bought in-store a lot. As prices creeped up and up, I couldn’t afford those prices anymore.”

Haley Sacks, a millennial financial-advice content creator known online as Mrs. Dow Jones, collects handbags and likens major auction houses to brokerages.

“You go to Fidelity or Vanguard to buy index funds or stocks. You know by going to them that those are trustworthy places to exchange your money for an asset,” she said. “You’re not on the street with someone random. It all feels very protected and pre-vetted. That’s the same exact thing as with an auction house.”

This post was originally published on this site be sure to check out more of their content.