Fashion has always been notoriously fickle and brand popularity can wane seemingly overnight.

Retail Gazette takes a look at the fashion retailers that were once some of the most coveted brands around but now no longer hold mass appeal.

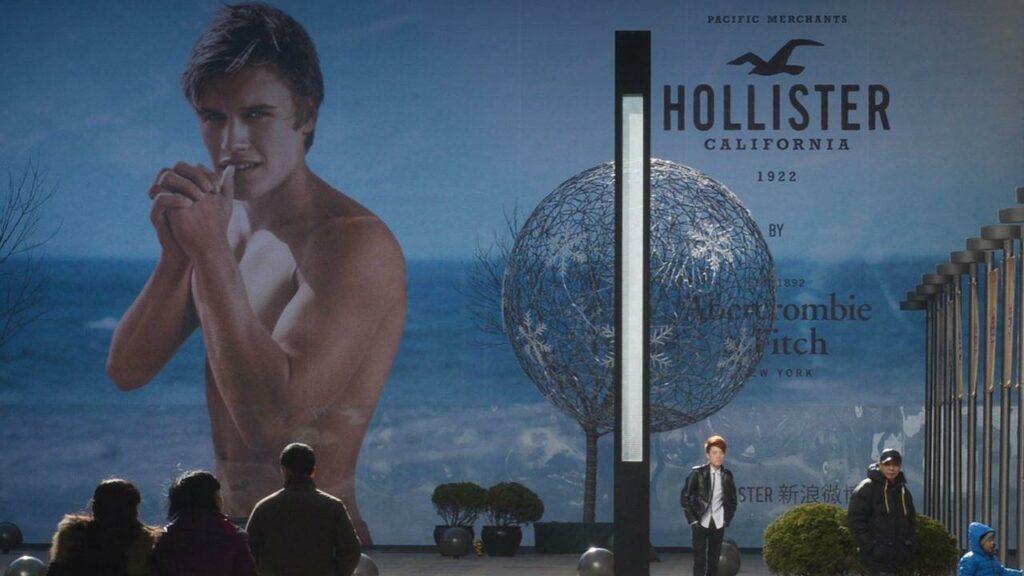

Hollister

A decade ago, you couldn’t walk into a shopping centre without seeing rafts of teenagers clutching Hollister shopping bags with shirtless men plastered on the fronts.

The American retailer opened its first store outside of the States in Brent Cross, London back in 2008 before going on an expansion spree across the UK, including in Manchester, Liverpool, Bristol, Birmingham, Southampton and Newcastle.

At its height of popularity, the dimly-lit stores surrounded by half naked male greeters was the pinnacle of aspirational fashion.

Whether you could only afford a hair scrunchie or a hoodie, just being spotted inside the store was enough for many.

But Hollister’s “good looking people only” attitude didn’t fit with growing calls for inclusivity across fashion, and as its core customer base grew up and moved away from the brand, it struggled to appeal to the new generation.

Bloomberg reported that from a survey asking high-income teen girls to name the brands they no longer wear in 2021, Hollister came in at second place.

The retailer has undergone several brand revamps over the years alongside Abercrombie & Fitch, both owned by A&F Co, but both brands have failed to replicate the popularity achieved in the early 2010s.

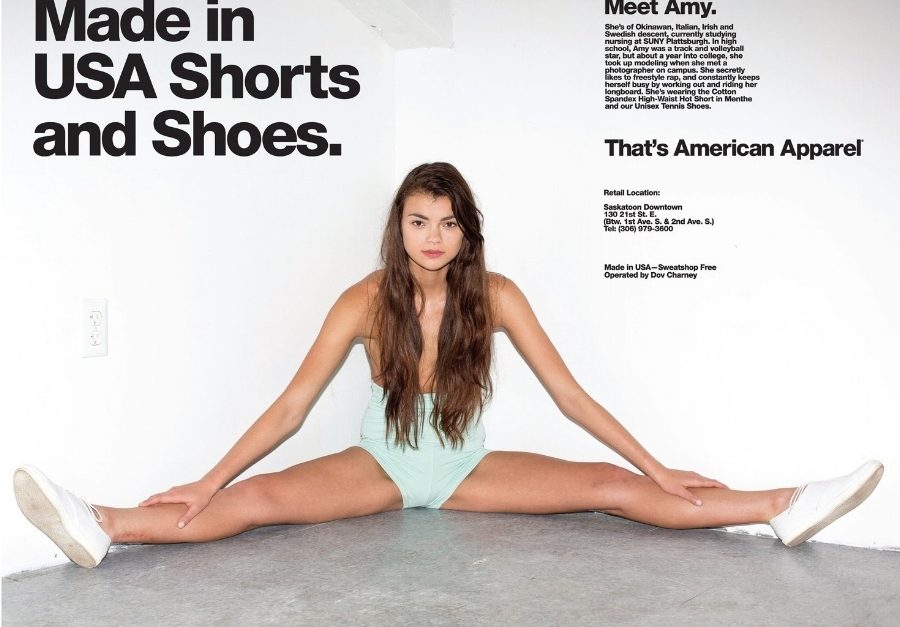

American Apparel

At its height of popularity, American Apparel, which made all of its clothing in the US, was available in more than 20 countries and at over 200 stores.

At one point becoming the biggest clothing manufacturer in America with annual sales of $630m.

The retailer was notorious for its steamy advertising campaigns, which often featured young female staff members alongside its cult products including the infamous tennis skirts and disco pants.

However, the business began struggling to compete amid the financial crisis, and the exploits of founder Dov Charney became known, as he faced a growing number of allegations about his treatment of women.

The alleged misconduct, coupled with questions surrounding its advertising methods, sent sales at American Apparel spiralling.

The board ousted Charney in 2014 before filing for a Chapter 11 bankruptcy a year later.

In 2016 the retailer shuttered all its UK stores with loss of 150 jobs.

The company still exists today, under the control of Canadian company Gildan Activewear, Inc but with a very different business model, miles away from its made in the USA ethos, and has of yet failed to capture the hearts and minds of consumers like it had done before.

Jack Wills

Jack Wills was another staple among shoppers back in the 2010’s.

Famous for its preppy clothing, the retailer encapsulated the quintessentially top-flight British university look

Founder Peter Williams once said his original plan for the retailer was about “what being at a British university is all about and all the cool amazing stuff that goes with that”.

Thriving during the Made in Chelsea era, the business held a valuation £140 million.

The retailer used top universities across the country to promote its products, including Oxford and St Andrews, as it tapped into its consumer base and sold the British identity.

However, the brand fell by the wayside as streetwear and trendy clothing overtook the preppy look.

Jack Wills plunged into administration in 2019 and was snapped up by Mike Ashley’s Frasers Group.

The retailer has tried its best to rebrand, working with social media influencers to spread the word on its new ‘inclusive’ look.

Last year the It’s A Vibe campaign was quickly critiqued by people on social media.

One Twitter user said: “Jack Wills trying to rebrand itself as a cool, urban, trendy clothing brand makes me laugh. Company spent years branding itself as a brand for poshos and toffs and it’s now trying to capture the streets.”

Forever 21

While Forever 21 still trades in the US, at one point in time the fast fashion retailer was gaining traction in the UK.

The business made its UK debut in back in 2010 in Birmingham to the delight of teenager girls across the nation before expanding to London, Liverpool and Manchester.

CEO Larry Meyer had vowed to open on “every major city, mall and high street” across the UK.

However, just 9 years later, it closed all stores and ceased trading in the UK.

Despite the hype, ultimately Forever 21 struggled to compete with the UK’s bustling fast fashion scene, which includes H&M, Asos, Boohoo, and New Look.

However, it’s problems were not limited to the UK.

Once trading from 800 stores worldwide, the business went on to shutter 350 of them after filing for bankruptcy protection.

It closed the majority of its stores across Europe and Asia, and now trades solely in the US, Mexico and Latin America.

Paul’s Boutique

If you went to school in the noughties, you’ll be familiar with Paul’s Boutique, the British brand loved by both schoolgirls and adults.

Taking inspiration from New York’s hiphop and graffiti scene of the 80s, at one moment in time the Paul’s Boutique label could be seen on everything from bags to quilted jackets and hoodies.

At its height of popularity, the likes of Frasers and Selfridges were among the exclusive retailers stocking its products.

Unfortunately its success was short lived.

After sales started to boom, fake bags and hoodies began popping up as well as counterfeit websites.

Paul’s Boutique later admitted that cracking down on fakes in the UK and abroad became its “biggest headache” with the company spending £2m in one year solely to try and protect its brand identity and designs.

Paul’s Boutique is still alive and kicking today, however it’s aesthetic has been toned down in an attempt to grow its appeal.

Cath Kidston

Cath Kidston was a brand loved by yummy mummies everywhere and it floral printed designed covered a wide range of products from cushion covers to make up bags and even ironing board covers.

It’s popularity soared, not just at home but overseas too, with Far East shoppers particularly loving the nostalgic British chintz.

By 2014, it had more than 100 stores worldwide.

The retailer was sold to the Hong Kong-based private equity firm Baring Private Equity Asia in 2016, when founder Kidston exited the company.

While there were a number of contributing factors to Cath Kidston’s downturn, its biggest challenge was the niche nature of its product offer.

It plunged into administration in 2020 and was later bought by Hilco, before Next acquired the brand earlier this year.

Click here to sign up to Retail Gazette‘s free daily email newsletter

This post was originally published on this site be sure to check out more of their content.