With millions to choose from, whatever alchemy sees a woman opt for one handbag over another is as fascinating as it is opaque. Anyone who can crack the mathematical formula that determines why aspirational A is favoured over practical B or affordable C would become very rich indeed.

Beauty being in the eye of the beholder, whichever bag you believe to have the X factor will depend entirely on your budget and personal taste. Subjective as it is, however, for a portion of the 2000s, a vast number of women agreed that the It bag to end all It bags was Mulberry’s Bayswater. Launched in 2003, the Bayswater was aspirational, practical and affordable, priced at £495, a figure that seemed reasonable then and seems all the more reasonable now, when entry-level designer handbags routinely cost four figures. High-profile British fans included Kate Moss, Sienna Miller and Alexa Chung.

Kate Moss in 2004

Credit: Getty

The Bayswater may have marked its 20th birthday last year, but five months on, there’s little to celebrate. Earlier this week, Mulberry reported a 4 per cent decline in annual sales, resulting in the company’s share price – which has already fallen by nearly 60 per cent this year – dropping by a further 4.5 per cent. “Mulberry has not been immune to the broader downturn in luxury spending in recent months, particularly in the UK and Asia,” said Mulberry’s chief executive, Thierry Andretta. “Looking ahead, the trading environment remains challenging, and we do not expect this to change in the short term.”

Mulberry is far from the only luxury brand to be struggling in today’s tough trading conditions. Last month, Kering, the French luxury goods conglomerate that owns brands including Gucci, Saint Laurent and Bottega Veneta, announced that first half profits were likely to drop by up to 45 per cent.

But Mulberry’s latest woes feel particularly poignant to British women of a certain age who fondly remember its heyday. Throughout the early 2000s, a Mulberry handbag was the holy grail. It had its own pet name (“Mulbs”), a well-loved British designer (Stuart Vevers, currently riding high at Coach in New York) and a celebrity following. Mulberry identified Chung as a chic, fabulously stylish young Brit long before other brands followed suit, promptly naming a bag after her, the Alexa, in 2010.

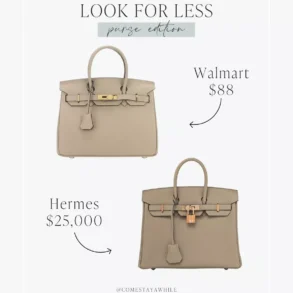

A large part of Mulberry’s appeal, both at home and internationally, was that it was designed and manufactured in Britain. Founded in 1971 by Roger Saul, it was regarded as one of the UK’s most coveted luxury brands, pointedly marketed to emphasise its heritage and craftsmanship in much the same way as Hermès, albeit on a smaller scale. Bags were manufactured at the Rookery, its leather goods factory in Somerset, and quality was high. Bayswaters would pass down from mothers to daughters much like Birkins would. But where a Birkin, even in the 2000s, cost four figures, a Bayswater still cost three, making it attainable to a far broader audience.

As a fashion editor in the 2000s, I could tell that Mulberry held a special place in people’s hearts because it wasn’t just other fashion editor friends who wanted one. It was your mum’s friends, your husband’s best friend’s wife, and your sister. In its heyday, Mulberry transcended its natural customer base of high earners who could drop £495 on a Bayswater without thinking twice. Whether to mark a landmark birthday or a promotion, Mulberry was perceived as a brand worth saving for – the ultimate investment piece, a soft leather slice of aspiration.

‘It girl’ with the ‘it bag’: Alexa Chung was never far away from her Mulberry bag – and even had one named after her

Credit: WireImage

Until it wasn’t. Most would opine that things went wrong when Mulberry started to raise its prices too steeply. Bags that once seemed within reach (albeit with some judicious saving) became remote, spirited away on a breeze of luxury rebranding, at the behest of a new chief executive who joined in 2011, poached from Hermès. In 2013, designer Emma Hill, who took over from Vevers in 2007, resigned. Not even a collaboration with model-of-the-moment Cara Delevingne could shift the perception that Mulberry had become too inaccessible. In 2015, Johnny Coca was appointed as creative director. A Spaniard with impeccable credentials, who had worked under Phoebe Philo at Céline, he resigned in 2020 – since then the brand has been designed by an anonymous in-house team.

This forgoing of a named designer is characteristic of Mulberry’s more taciturn marketing approach in recent years – paradoxically, at a time when most would agree that it has never needed to amplify its message more forcefully. In its 2000 heyday, no expense was spared on Mulberry’s fashion shows or parties: it always showed at London Fashion Week, in luxe venues such as Claridge’s, with an impressive celebrity front row. Press coverage was commensurately lavish. Pre-social media, the only way to get your bag seen was by ensuring it was worn by the right people, and Mulberry was at the vanguard of identifying the potential in partnering an It bag with an It girl.

But times have changed. “There’s nothing comparable to that [“It girl”] Alexa moment, especially now that so many trends are set on TikTok, which is so fragmented,” says Sara McCorquodale, the founder of influencer intelligence company Corq. “There is no ultimate authority when it comes to fashion anymore – people tune into the content that resonates most with them personally.”

Rather than simply spending more money on marketing, McCorquodale believes that Mulberry needs to be more strategic if it is to bounce back. “Marketing budgets are definitely a factor, but many brands are still not maximising the opportunity that social media and influencers offer them,” she says. “TikTok and Instagram set the rhythm for so many shoppers now, and Mulberry would benefit from having a long-term strategy on how to capitalise on this.”

McCorquodale also believes the brand should be building on the current wave of Y2K revivalism. “They should be pushing the Alexa bag to tap into Gen Z consumers’ love of nostalgia. They should be working with influencers to drive purchase of new products, but also to ensure their brand is desirable in “pre-loved” shopping communities on social media, and has a high value there. This would improve consumers’ perceptions of the brand from multiple angles.”

Lana Del Rey with her Mulberry bag at London Fashion Week, 2012

Credit: Getty

But if brand perception is currently weak, the product itself could also be stronger, according to Benjamin Wild, a senior lecturer at Manchester Fashion Institute, part of Manchester Metropolitan University. “Fundamentally, the appearance of Mulberry bags has remained unchanged for years,” he notes. “By contrast, other luxury brands have brought out many new collections, including mini bags and extended tote ranges. These designs draw upon the brands’ heritage, but offer something new and contemporary.”

Wild also believes that Mulberry’s pricing is an issue. “While its declining sales can be linked to a downturn in luxury spending, this is not the whole story. Mulberry bags are costly, but they are cheaper than Loewe and other luxury brands. This makes them more susceptible to shifts in consumer confidence. For an accessible brand like Mulberry, prices will be subject to greater consumer scrutiny, especially during times of stringency.”

At £995 for a Bayswater and £1,195 for an Alexa, Mulberry is still more affordable than Loewe, Prada or Louis Vuitton, whose bags routinely cost upwards of £2,000. But wages haven’t increased in line with luxury handbag brands’ inflation, with the result that even an entry-level Mulberry bag is now out of the reach of most.

Meanwhile, a slew of handbag brands have come along to steal Mulberry’s “affordable luxury” crown, such as DeMellier, Wandler and Strathberry, a favourite of the Princess of Wales. Priced between £300-600, they’re perfectly placed to seduce those customers whose disposable income hasn’t risen much since they spent £495 on a Bayswater 15 years ago.

Add to this the allure of cult European brands such as Acne Studios, Ganni and Sézane, whose bags are well designed, competitively priced and amplified by the womenswear collections for which they’re also known and loved, and it’s easy to see why Mulberry is in the doldrums. Loyal as customers are, they’ve never had more choice.

How to win them back? Enlisting Alexa Chung to design her own bag collection in 2021 was a clever move, but so, too, would be the appointment of a named designer. The allure of Loewe’s Puzzle bag is closely aligned with the allure of its designer, JW Anderson. Quality and heritage are important, but they are hardly USPs. A bag, like a brand, has to stand for something. Mulberry needs to shake off its recent British reserve and shout about its handbags from the rooftops – because they’re certainly still worth shouting about.

This post was originally published on this site be sure to check out more of their content.