ASIC is back with new ways to ‘fix things’ following damaging testimony in yet another Senate Estimates hearing this week. Whatever the fix might be, holding Big 4 accountants or big corporates to account is still not in the corporate regulator’s plans. Michael West and Kim Wingerei report.

You could drive a truck through it, no make that a road train – ASIC’s view of itself that is, versus that of its critics.

In this week’s Senate hearing, the Australian Accounting Standards Board (AASB) told Senator Deborah O’Neill that ASIC had refused the AASB access to the financial accounts of the Big 4 (EY, PwC, Deloitte and KPMG) because “it might offend”. Instead, the AASB had to purchase the data from a third-party (private) company.

But fear not, according to ASIC Deputy Chair Sarah Court, speaking at the ASIC annual conference this week, ASIC is “without doubt, one of the most active enforcement agencies in the country”. Chairman Joe Longo went even further, proclaiming ASIC to be “probably the most active law enforcement agency in our space, not only nationally, but globally”.

Court and Longo also outlined the regulator’s focus over the next year, in particular on superfunds, where it has several enforcement cases ongoing.

Neither of them seemed particularly concerned with ASIC having a lack of resources to do its job, despite it being severely short-changed by the Government.

Government cash-cow

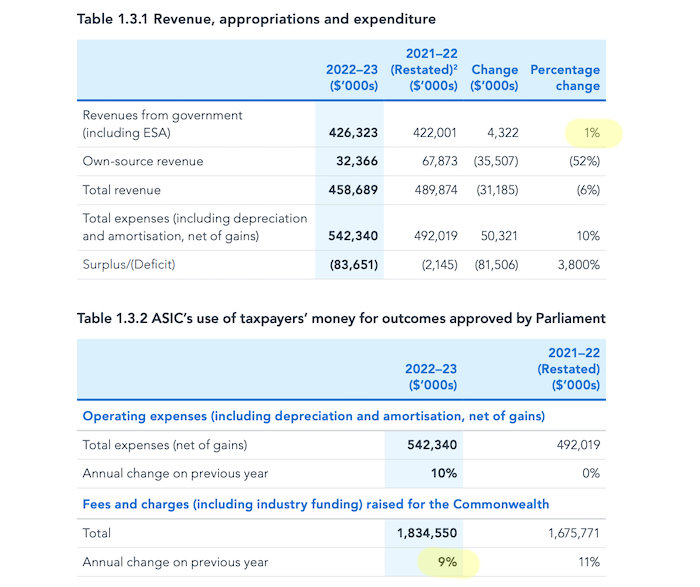

According to its latest annual report, ASIC fees paid to the Federal Government – mostly deriving from the businesses it regulates – were $1.834B last financial year. This consists of the annual registration fees it charges business, corporate search fees and other ‘industry funding’. The annual report is scant on detail, but the fees and charges will also include “world-class” late payment fees of 130%.

Whether these come from multinationals – which routinely flout the disclosure laws – or small businesses, is not determined.

ASIC charging 130% late fees to small business. What’s the scam?

But here is the catch. While the Government trousers the $1.8B, ASIC receives only $426M to do its job. Treasurer Jim Chalmers keeps the other $1.4B for the Budget.

So why would Jim upset that apple cart by insisting ASIC upped its enforcement and spent a whole lot of money getting nasty with mates like PwC? Or any number of frequent breakers of the Corporations Act at the Big End of Town.

You will notice also that the fee revenues for govt were up 9 per cent while the ASIC budget edged up just 1 per cent! Jim – “That’s nine per cent for us, one per cent for you,” keep up the good work.

What ASIC really does

To put it in layman’s language, the point of ASIC is to maintain not disrupt, to protect, not reform. ASIC is not there to charge about like Wild Bill Hickok busting up big-time stage-coach robbers. It’s more about chucking the saloon drunkard in the cell for the night.

They are a tax collector. That’s why they don’t go after the big end of town; it’s expensive, and besides, they are our friends! The banks and blue-chippers are essentially good, the baddies are small-time financial planners, late payers and the odd whistleblower.

That’s why the enforcement numbers which Joe Longo cites in evidence of ASIC’s usefulness will all be first class nobodies. It’s about quantity not quality.

So it was when the PwC scandal broke this year and ASIC was nowhere to be seen, and it finally became public awareness that the Big 4 was a big con. The response was this corporate genocide is unfortunate but well here is the preface in the annual report …

ASIC performs a crucial role in maintaining Australia’s position as having one of the most stable and successful financial systems in the world.

You get the picture, total and utter denial. The operative word is ‘maintaining’.

In fact, this ‘persecute the poor and pay homage to the rich’ approach to regulation was perfectly enshrined in a recent senate inquiry which heard testimony from a whistleblower raided at home in bed, tied and gagged in front of his fiancee.

Whistleblower raided in bed, gagged, while Big 4 run amok and regulators duck for cover

In the same hearing a day or two later it emerged that there was another regulator called the Companies Auditors Disciplinary Board. We had a good look at this mysterious CADB.

Its big – and singular – enforcement action last year was – not, of course not, KPMG’s massive audit cheating scandal or any of the dozens of Big 4 audit scams exposed over the years in these pages – rather, it was the prosecution of Rocco Luciano Spagnolo, an auditor from Griffith in respect of his audit work for an insurance broker in Merryjig in rural Victoria.

Lay off the Big 4

We have spent literally years here exposing audit frauds by Big4 and their clients – News Corp, Lend Lease, SAB Miller, Goldman Sachs, to name a few – do you think there is one skerrick of evidence CADB ever bothered to look at one of them?

No, but Rocco Spagnolo watch out!

This post was originally published on this site be sure to check out more of their content.