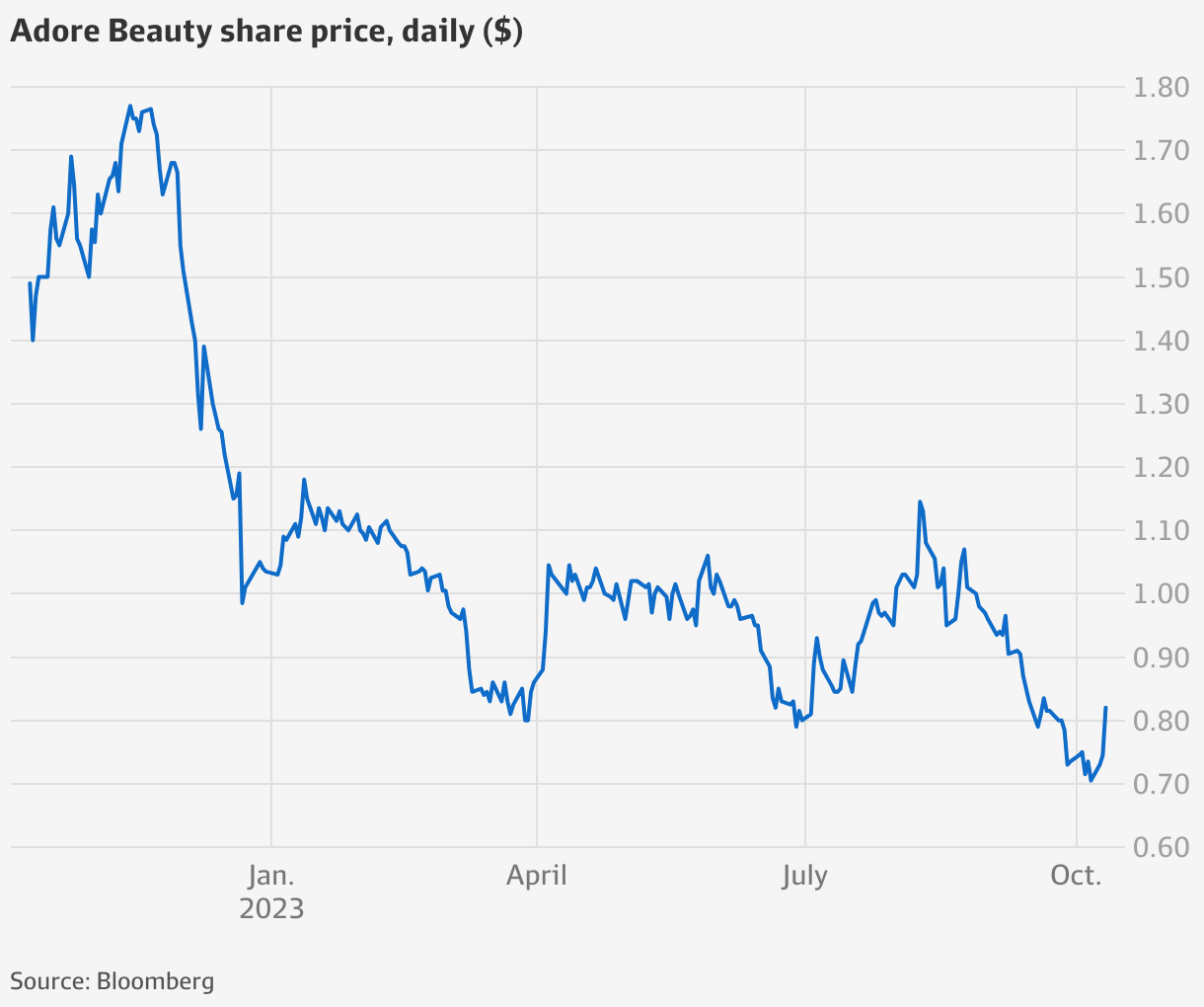

It’s back to the future at Adore Beauty, which floated at $6.75 a share three years ago and had sunk to just 82¢ as of Wednesday evening.

Street Talk can reveal Adore Beauty has hired UBS as its defence adviser, bringing the Swiss bank’s operatives into the tent after the team helped founder Kate Morris and Quadrant Growth Fund list the company on the ASX boards in October 2020.

You would think with an 88 per cent slump in Adore’s share price, its management – now led by ex Priceline executive Tamalin Morton – would be thinking hard about whether the company is vulnerable to opportunistic acquirers. There’s also stakes held by the co-founders and Quadrant that have been hard to sell with the share price in the doldrums.

And so, UBS’ emergence in Adore Beauty’s camp is not surprising. The big question, is whether Adore is simply getting on the front foot, or if there’s a suitor circling Adore’s once red-hot business. Morris declined to comment on UBS’ appointment or whether the company had received an informal, non-binding approach, when contacted by Street Talk on Wednesday.

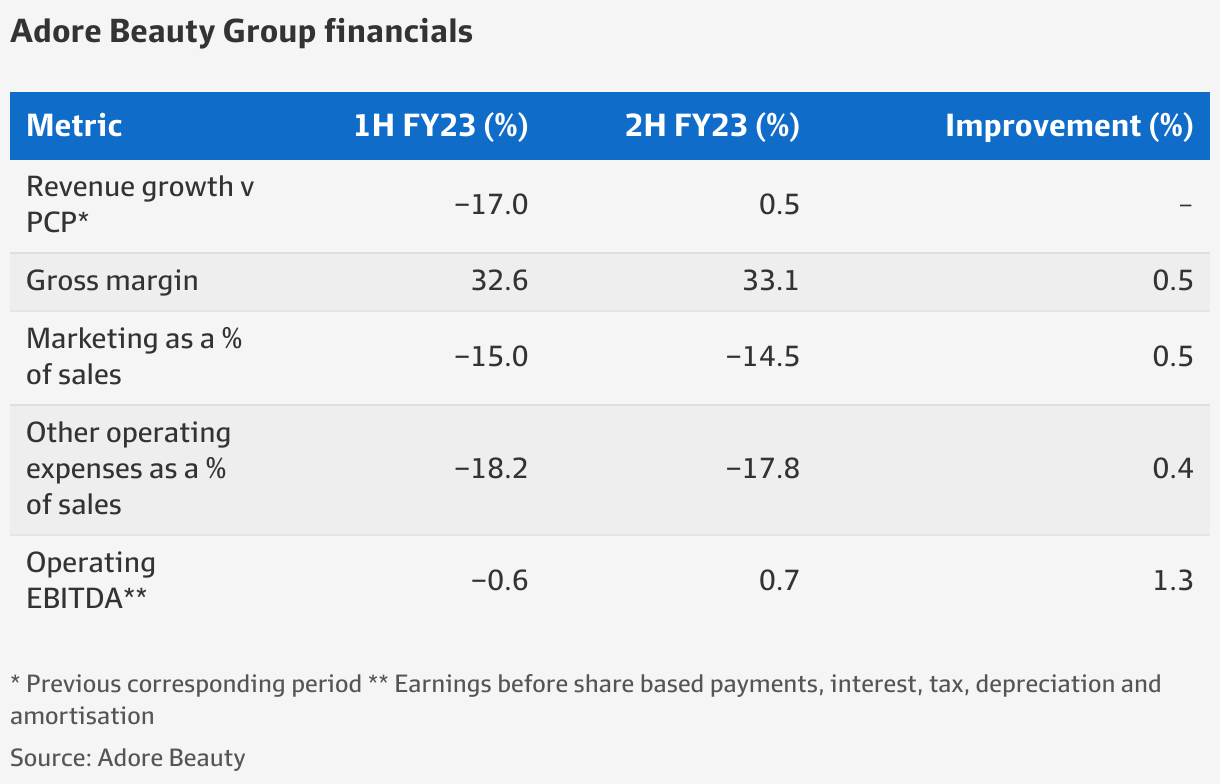

The retailer posted $180.6 million revenue and $0.6 million EBITDA for the 2023 financial year. Turn back the clock to its IPO and Adore Beauty pulled in $121.1 million revenue and $5 million earnings in the 2020 financial year.

Its listed life has been plagued by rising interest rates and pandemic highs that didn’t prove sustainable. Priced during the ZIRP IPO frenzy, Adore Beauty sold shares at an enterprise valuation that was 3.9-times annual revenue.

Hello, good lookin’

Interested parties (and Adore) would no doubt be taking heart from a revival in local beauty and fashion deals. Most recently, and as reported by Street Talk, New York private equity firm Aria Growth Partners is seeking to buy a minority stake in sunscreen brand Ultra Violette.

Melbourne-based Aesop made headlines in April when it fetched $3.7 billion for its Brazilian parent, Natura & Co, in a sale overseen by Morgan Stanley and Bank of America. The brand posted sales of $US537 million in fiscal 2022 and had about 25 per cent profit margin.

Consumer bankers delivered another headline-grabbing deal a few months earlier, after women’s fashion brand Zimmermann caught the attention of US private equity firm Advent International, as revealed by Street Talk. Advent confirmed its acquisition of a 70 per cent stake in the business in August, in a deal that valued Zimmermann at $1.5 billion to $1.75 billion.

This post was originally published on this site be sure to check out more of their content.