Luxury brands are quietly slashing the prices of designer handbags after getting ideas above their station.

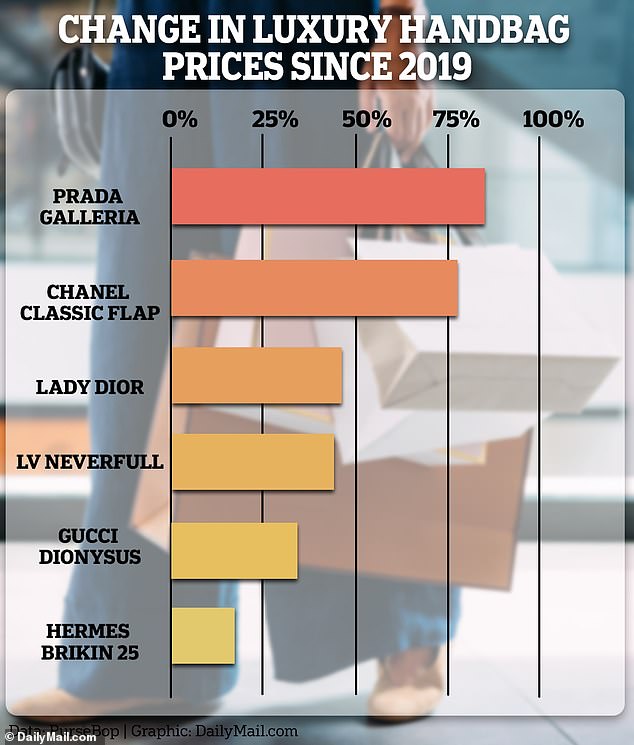

Brands including Burberry and Yves Saint Laurent have spent years ramping up the cost of their sought-after accessories in a bid to improve their cachet.

But Burberry has lopped 22 percent off the cost of its medium-sized Knight handbag, and YSL has cut the cost of its Loulou bag by 10 percent after discovering they had squeezed out the customers who keep them in business.

‘When you move upmarket, you can’t start with raising prices; you have to start with desirability,’ said Pauline Brown, former chair of the LVMH which owns Louis Vuitton.

‘None of this happens overnight — you have to bring the consumer along with you.’

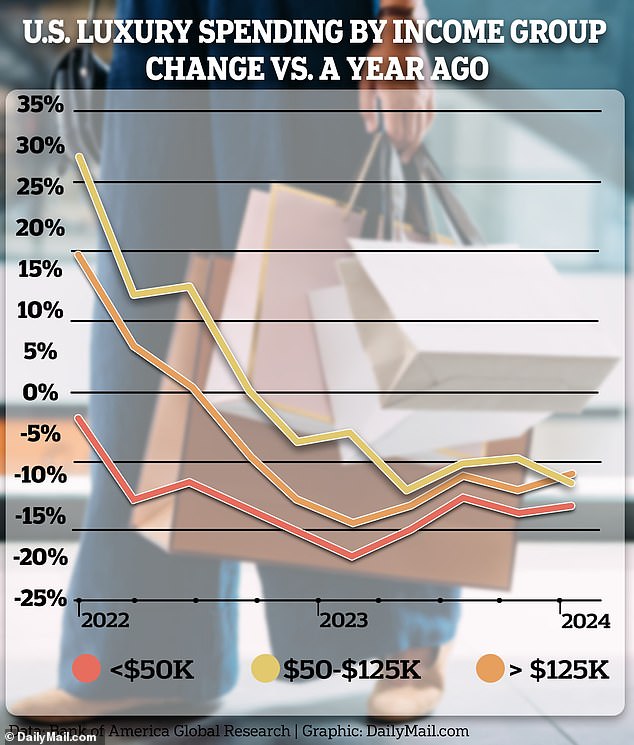

There are around 2.5 million people worldwide who spend more than $20,000 a year on luxury goods, according to analysis by the Boston Consulting Group

But they account for just 10 percent of sales, while more than half of sales are made to around 330 million people who spend less than $2,000 a year.

Spending by both groups has plummeted since the pandemic as consumers have tightened their belts at a time when luxury brands have been ramping up prices in a bid to retain their ‘exclusive’ image.

But Burberry sacked its chief executive last week after its fourth profit warning in nine months as its share price dropped to a 14-year low.

German designer Hugo Boss has also issued a profit warning and net profits at Swatch are down 70 percent so far this year because of a ‘huge reduction in demand’ from customers in China.

Burberry has now slashed the price of its Knight handbag and knocked 5 percent off the price of all bags designed by top designer Daniel Lee.

While Yves Saint Laurent Loulou bags can now be bought for $2,650 in US stores – down $300 since January, according to the WSJ.

And the stakes have grown higher with the sale of handbags now accounting for an average of 45 percent of luxury brand revenue – up from 34 percent in 2008.

New Burberry CEO Joshua Schulman has promised to make its luxury goods more accessible to its most loyal customers.

But its small Lola bag still costs over $2,000 – 40 percent more than before the pandemic, while YSL’s Loulou bag could be bought for $2,050 at the start of 2021.

Only the most exclusive brands appear able to snub the purchasing power of the middle class, with Cartier owner Richemont last week reporting a four percent rise in sales for its jewelry brands including Van Cleef & Arpels.

Gucci is doubling down on plans to prioritize its wealthiest customers, the WSJ reported, while analysts will be closely watching earning reports from Hermès and Louis Vuitton later this week.

The tail-off in US sales has been mirrored in the massive Chinese market where consumers are being squeezed by a prolonged crunch in house prices.

And luxury brands have been nervously watching moves by cheaper rivals to scoop up customers they have alienated.

Chinese manufacturers including Songmont which produce quality goods that heavily undercut their upmarket rivals are eating into the luxury market previously dominated by Western brands,’ the WSJ reported.

‘Brands cannot afford to alienate these customers,’ warned analyst Claudia D’Arpizio of Bain & Company.

This post was originally published on this site be sure to check out more of their content.