A pair of Californians aren’t exactly thrilled that they couldn’t buy Birkin bags while shopping at Hermès. So they’re taking their grievances to court, with a lawsuit that suggests that the French luxury brand has engaged in unlawful sales practices and broke antitrust laws when selling its handbags, a status symbol that can cost tens of thousands of dollars.

Tina Cavalleri and Mark Glinoga filed the lawsuit Tuesday against Hermès International for violation of unfair competition and antitrust laws and are seeking class action status. They claim Hermès has illegally forced customers to spend thousands of dollars on ancillary products to gain access to the Birkin bag.

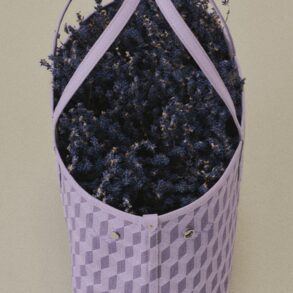

The Birkin has built a reputation as the most coveted handbag in the world. Many consider it an investment piece, as reliable as fine jewelry, and since its introduction in 1984 it has retained its mystique even as whims in fashion change as quickly as the weather.

The plaintiffs said in the complaint that the high demand and low supply of Birkin bags, which begin at $10,145 for a Birkin 25, gives Hermès market power that it exploits by requiring consumers to purchase other items before the Birkin. Through this practice, according to the complaint, Hermès can increase the price of the Birkin bag and gain additional profits from selling the bags.

According to the complaint, Hermès sales associates are asked by the luxury brand to offer the Birkin bags to customers who have a long-standing relationship with the brand and have purchased other products, such as shoes, scarves and jewelry.

“Most consumers will never be shown a Birkin handbag at Hermès retail store,” the lawsuit says. “Typically, only those consumers who are deemed worthy of purchasing a Birkin handbag will be shown a Birkin handbag (in a private room).”

Both Cavalleri and Glinoga have a history of shopping at Hermès boutiques. According to the lawsuit, Cavalleri spent “tens of thousands of dollars” on Hermès ancillary products before obtaining a Birkin bag. When she asked about buying another Birkin bag around September 2022, she was told the bags were only offered to “clients who have been consistent in supporting our business.” She ultimately did not obtain another bag that month, according to the lawsuit, knowing she would have to spend more money to do so. (It’s unclear whether she ended up buying another bag at a later date, or how many Birkin bags she owns.)

Representatives for Hermès did not respond to a request for comment.

The proposed class-action lawsuit takes aim at a long-standing practice in which luxury brands offer items to buyers who have a history of shopping with them.

The appeal of the Birkin is its rarity — in a 2001 episode of “Sex and the City,” one character is told the wait to buy one is five years long — along with the obfuscation surrounding the purchase process.

On forums such as PurseForum and the subreddit the Hermes Game, customers recount how they scored their Birkins and offer tips. Some report walking into Hermes for the first time, asking for a Birkin and receiving one, while others plead for advice about how to approach the topic with their sales associate.

The scarcity of the bag, paired with its desirability, has led many shoppers to the secondary market, where a relatively untouched (or even brand-new) bag can be bought for tens of thousands of dollars or more. (Brand-new bags often come from Hermes shoppers who were offered a colorway or style of the handbag that they didn’t prefer but felt that decorum dictated they couldn’t turn the offer down.)

Many fashion houses encourage clients to, in retail terms, “establish a sales profile” by purchasing items across the brand’s profiles, which in luxury fashion can include porcelain, men’s and women’s clothing, towels, furniture and other accessories. Chanel customers, for example, have reported that they receive better treatment and products if they purchase clothing in addition to handbags. Louis Vuitton has allegedly told customers that, to secure the most elaborate pieces from Pharrell Williams’s menswear collections, they must first purchase pieces from among Vuitton’s other offerings.

Experts are uncertain about the merits of the case, saying that Hermès has a monopoly only over its own product and that it isn’t impacting shoppers at large. The fashion brand is inconsistent with its practices too, experts say, which gives it a lot of leeway in how and when the bag is distributed. There isn’t a blanket policy that the lawsuit can attack.

“Hermès has it in the bag,” said Susan Scafidi, academic director at Fordham University’s Fashion Law Institute. She said the luxury brand doesn’t tell buyers how much they need to spend to gain access to the Birkin, which makes it harder for the plaintiffs to pinpoint a problem with their policy.

Offering the Birkin depends on a number of factors, she said. It could be the state of the economy, the supply of bags or the relationship with the brand.

“Are you a celebrity? Are you someone who will carry that Birkin publicly and prominently?” she asked.

Robert Freund, a lawyer who has represented clients in consumer class actions, said that the lawsuit against Hermès could have an instant impact for all consumers, especially those who have experience with gatekeeping when buying products.

“If a fast-food restaurant says you want to buy a dessert, you have to buy a meal — that’s tying one thing to another. When does tying one thing to another become something that’s illegal? How does all that work?” Freund asked. “And even if it is legal or illegal, is it fair?”

Freund said that class actions often start with a limited group filing the complaint. It’s a misconception that one or two people filing the complaint won’t lead to a bigger case, he said.

All eyes should be watching this case, Freund said, “even if you’re not somebody who would ever be in the market for a Birkin bag.”

This post was originally published on this site be sure to check out more of their content.