- Attractive margins

- Growing free cash flow

We described Hershey Company (US:HSY) just months ago as a producer of “frankly inedible chocolate”, but there is no denying that the company boasts a brand range that few competitors across the Atlantic can match. Several of the manufacturer’s products will even be familiar to UK snackers, such as Reese’s peanut butter cups and Kit Kat bars (the company has licensing agreements to produce and sell Kit Kat, Cadbury, and Rolo products in the US). Other brands, such as Milk Duds and Pirate’s Booty, tend to be strictly North American affairs.

Brand power has helped Hershey, which was established in 1894 in Pennsylvania, take around a 45 per cent market share in US chocolate. Growth prospects stem in part from its North America salty snacks division, which sells Skinnypop popcorn and Dot’s pretzels, and which the company is attempting to scale up significantly.

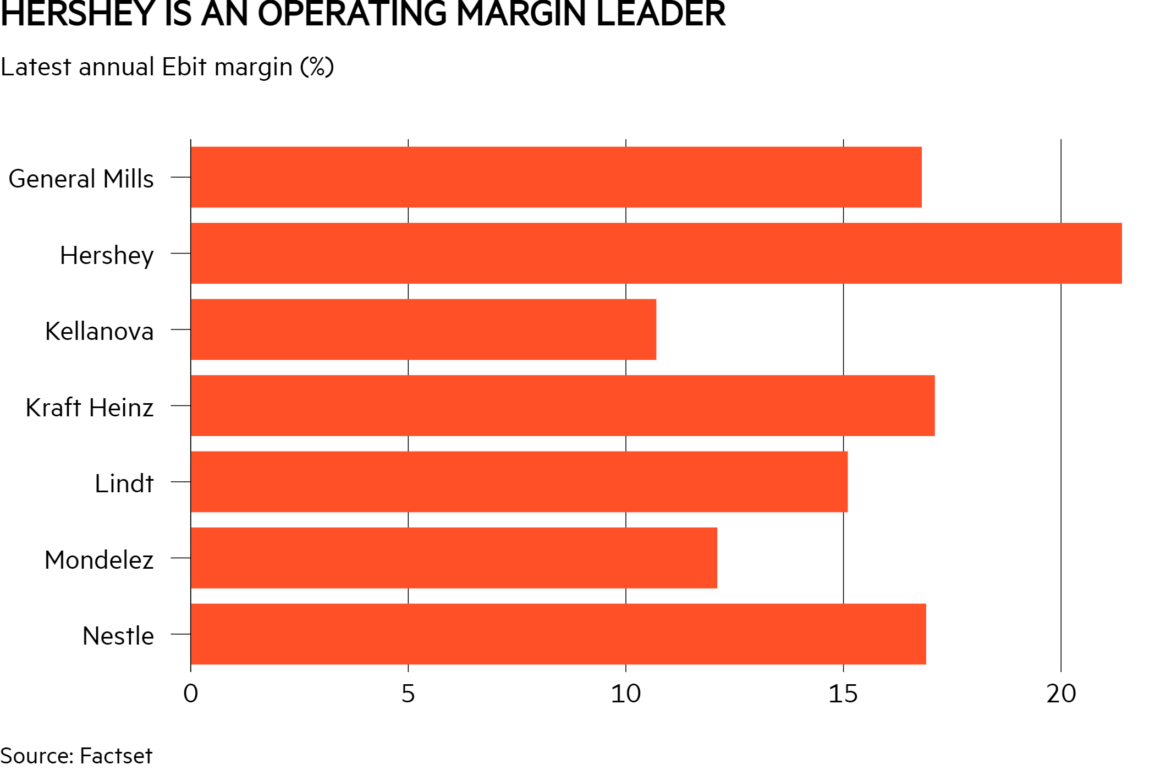

Behind the product portfolio sit some attractive financial metrics. The operating margin has been consistently over 20 per cent and is comfortably ahead of food sector competitors such as Kraft Heinz (US:KHC), General Mills (US:GIS), and Mondelez (US:MDLZ).

While Hershey’s return on equity has fallen over the last few years, the latest annual figure was still north of a more-than-respectable 50 per cent. And its chunky free cash flow is heading in the right direction, with the analyst consensus being for this to grow by around £700mn between 2023 and 2026 to surpass £2.3bn.

Elsewhere, leverage is undemanding at around 1.7 times. Stifel analyst Matthew Smith thinks the company’s balance sheet position gives Hershey “optionality for share repurchases and M&A”. Buybacks have been a feature of Hershey’s capital allocation strategy, and while its dividend yield of 2.5 per cent is little more than par for the course among its US peers, annual dividend growth over the past half decade has averaged almost 9 per cent and is forecast to top 14 per cent this year.

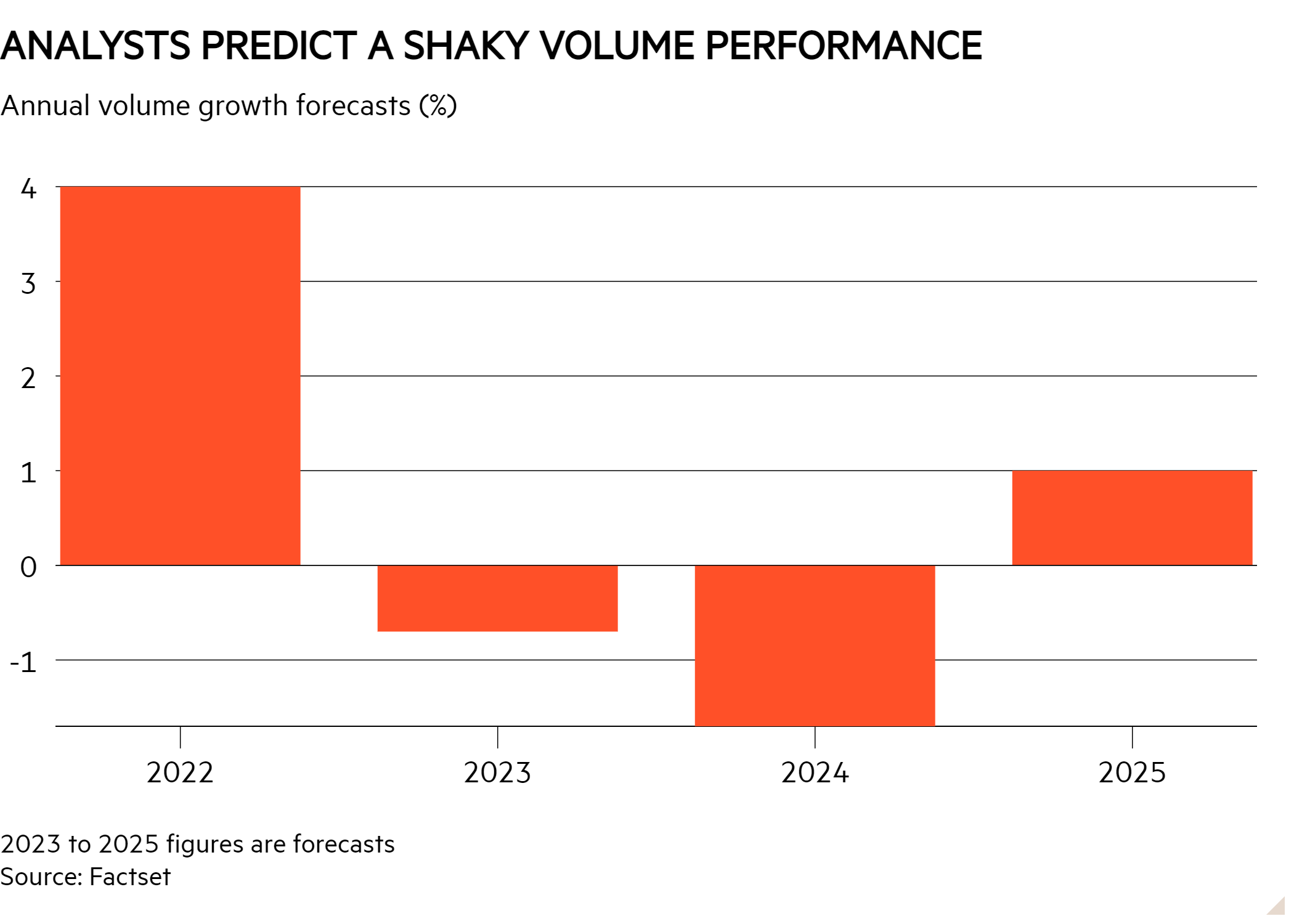

But it’s not all roses. Soaring cocoa and sugar costs have forced Hershey to raise prices higher, impacting consumer demand. These increases are behind the sales uplifts this year at the company’s three divisions – revenue driver North America confectionary and the much smaller salty snacks and international units – volumes, meanwhile, have struggled.

Confectionery volumes fell by 1 per cent in the third quarter as prices rose by over 11 per cent. International volumes fell by 5 per cent, with salty snacks volume growth of 22 per cent the only bright spot. Analysts expect volumes to fall this year and next, with minimal growth in 2025.

This isn’t a company-specific headache, but a sector-wide one. Either way, Hershey’s pricing strategy is paying off, given operating profits rose by a third in the quarter to $736mn (£603mn). It seems to be navigating consumer spending headwinds well, albeit margin expansion may prove harder to come by in the short term.

And despite the mixed volume picture, management has reiterated bullish full-year guidance. The board forecasts net sales growth of 8 per cent and earnings per share growth of 13-15 per cent this year, compared with long-term targets of 2-4 per cent and 6-8 per cent, respectively. At an investor day earlier this spring, the company said that it expects net sales growth of 3-4 per cent in 2024 and 2025 and an uplift of 2-4 per cent in 2026.

Still, all is not well in investors’ eyes. Despite the relatively robust trading figures, the shares have lost almost 30 per cent of their value since May as investors have become nervous about the impact of the new weight-loss drugs on customer appetite, among other factors. Companies such as McDonald’s (US:MCD) and Coca-Cola (US:KO) have also been hit this year for the same reason, with concerns raised that consumer habits could significantly change as more people use the new products.

It is far too early to accurately discern the long-term consequences of these drugs. But Hershey has some helpful factors playing in its favour. First, its demonstrable pricing power means it can still grow revenues and deal with weak volumes if consumption levels ease. Second, a significant chunk of the company’s sales are linked to Halloween and other holidays, and children aren’t the ones lining up to take the new drugs. Lastly, the new weight-loss options are expensive, meaning it isn’t easy for the standard US snacker to opt for them.

The upshot of this price activity is that the shares trade at 19 times forward consensus earnings, according to FactSet, a discount of a fifth to the five-year average. This looks undemanding giving Hershey’s pricing and brand strengths.

| Company Details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| Hershey Company (HSY) | $39bn | $191.48 | 27,688¢/18,374¢ | |

| Size/Debt | NAV per share* | Net Cash/Debt (-)* | Net Debt/Ebitda | Op Cash/Ebitda |

| 1,613¢ | -$4.76bn | 1.7 x | 107% |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | CAPE |

| 19 | 2.5% | 4.9% | 32.1 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 23.4% | 27.8% | 6.8% | 16.8% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| -12% | 7% | -14.4% | 0.1% |

| Year End 31 Dec | Sales ($bn) | Profit before tax ($bn) | EPS (¢) | DPS (¢) |

| 2020 | 8.1 | 1.54 | 629 | 308 |

| 2021 | 9.0 | 1.80 | 719 | 333 |

| 2022 | 10.4 | 2.03 | 852 | 383 |

| Forecast 2023 | 11.2 | 2.31 | 953 | 443 |

| Forecast 2024 | 11.6 | 2.45 | 1,011 | 487 |

| Change (%) | +4 | +6 | +6 | +10 |

| Source: FactSet, adjusted PTP and EPS figures | ||||

| NTM = Next 12 months | ||||

| STM = Second 12 months (ie, one year from now) | ||||

| *Includes intangible assets of $4.6bn, or 2,236c a share | ||||

This post was originally published on this site be sure to check out more of their content.