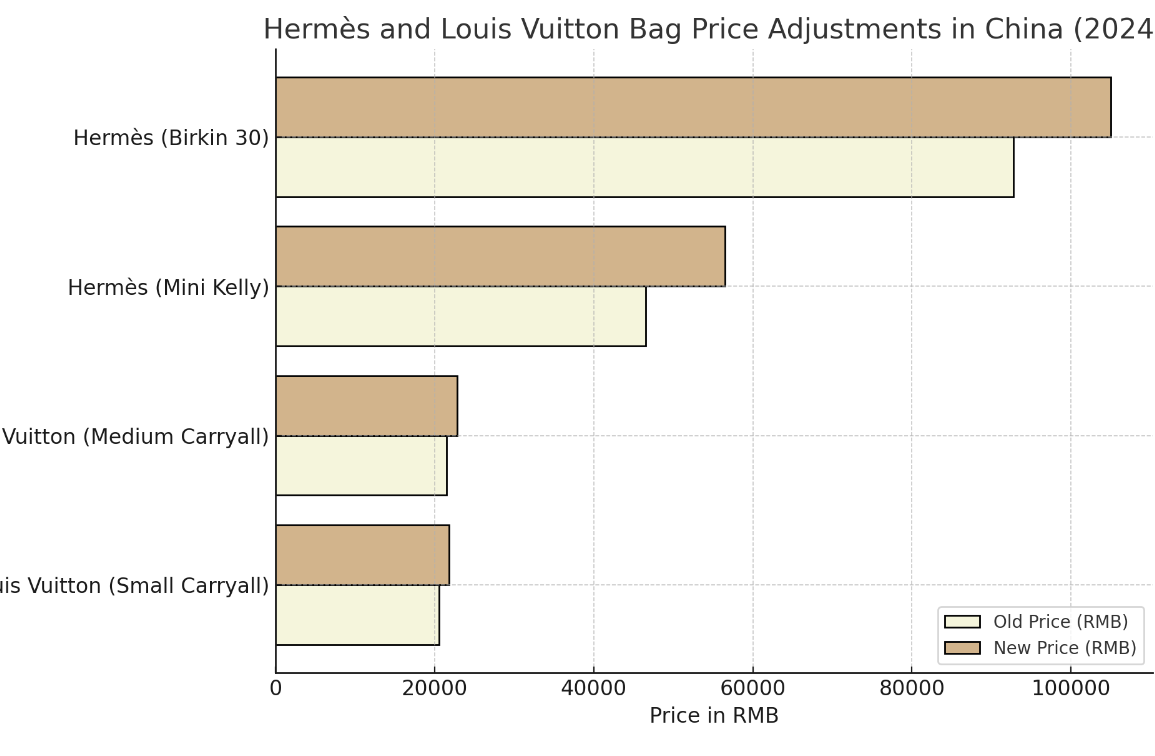

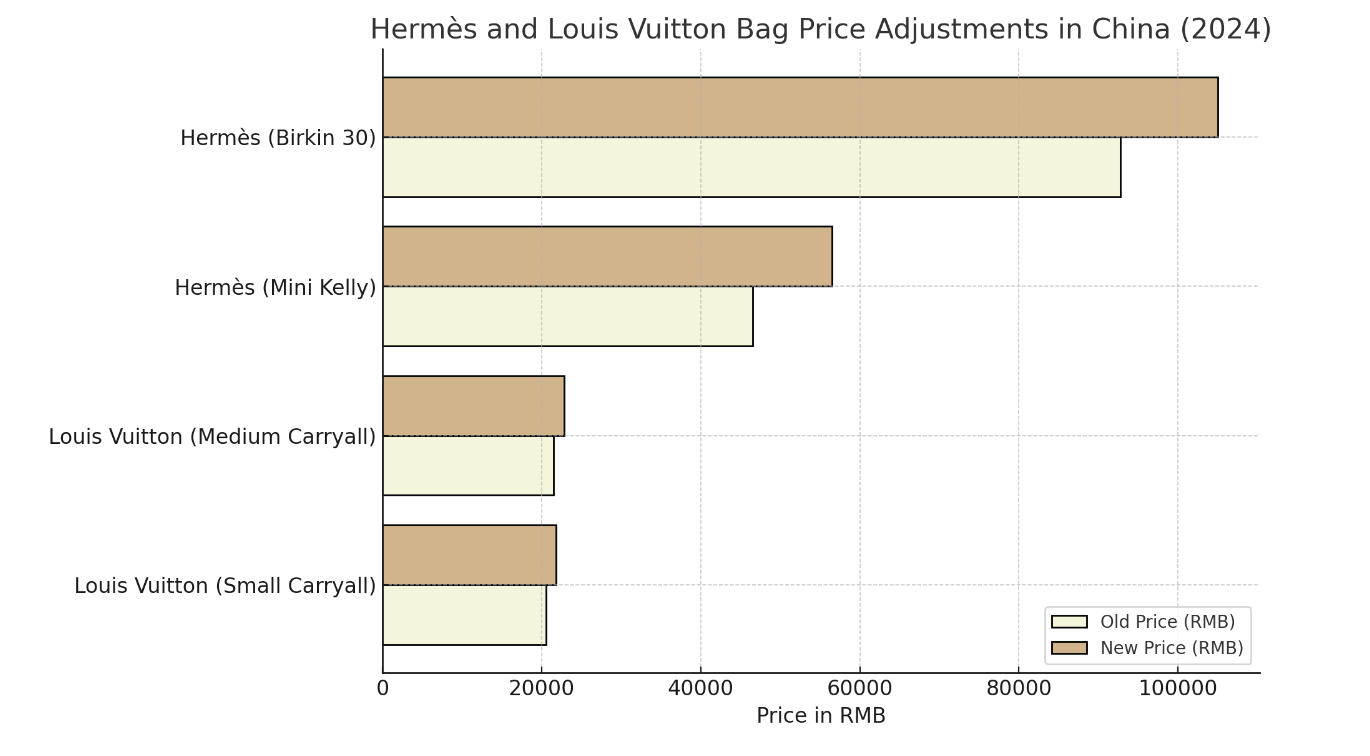

According to Chinese-language media, Louis Vuitton recently implemented its second price adjustment this year on select items in China. The French luxury house raised the price of its small Carryall handbag nearly 6% — from 20,600 RMB ($2,850) to 21,800 RMB ($3,020); while the medium version also rose 6%, from 21,500 RMB ($2,975) to 22,800 RMB ($3,155).

This price hike follows the 5% price adjustment post-Chinese New Year in Q1 for the same models.

Other luxury brands are adopting comparable strategies in China. Earlier this year, Hermès raised prices across its entire product line, with the price of the Mini Kelly increasing 21.5% to 56,500 RMB ($7,820). The Birkin 30 handbag surpassed the 100,000 RMB ($13,835) mark, jumping from 92,750 RMB ($12,835) to 105,000 RMB ($14,500).

Chanel, too, has adjusted prices this year, with rises ranging between 6% and 8% across East and Southeast Asia this spring. This came after two price increases last year: a 12.6% hike in March 2023 for classic flap bags, and a further 6% to 8% increase in September 2023 in markets including China, Thailand, Japan, and Australia.

According to company results, price hikes have yet to damage consumer demand for the world’s top luxury brands. LVMH, the parent company of Louis Vuitton, reported record figures for 2023: annual revenue of €86.2 billion ($93.6 billion), up 9% year-over-year, and a net profit of €15.2 billion ($16.5 billion) — an 8% increase.

Over the past three years, high-end luxury handbags have experienced an average price increase of over 32%, far outpacing China’s roughly 2% inflation rate and contributing to a 150% growth in profits. While Chinese consumers have – so far – continued to purchase luxury handbags, brands leave themselves open to perceptions of price gouging.

As Zhou Ting, director of the Yaok Research Institute and a luxury industry expert, told the Shanghai Observer, four main objectives underpin recent luxury price increases: Maintaining brand value and customer loyalty, stimulating demand, differentiating from mass-market brands, and maximizing profits. However, she notes that the luxury market is nearing saturation, with future growth likely dependent on high-end consumers rather than an expanding middle-class customer base.

But it is not just luxury brands like Louis Vuitton and Hermès raising prices; hikes have extended into the beauty and hard luxury segments in 2024.

Earlier this month, Estée Lauder raised prices by 10% to 20% in China across over 500 products under its portfolio brands, including La Mer and Mac. This price hike followed a muted turnaround in Estée Lauder’s financial metrics, as the company reported a 5% increase in global net sales and a 3% increase in net sales in the Asia-Pacific region in the first three quarters of the 2024 fiscal year.

Van Cleef & Arpels, too, enacted an 11% price increase in China last month, with consumers rushing to stores to purchase items like the popular Alhambra bracelet before the hike. This year, Rolex also implemented a global price adjustment with gold watches experiencing a 6% to 8% hike, owing to the rising cost of gold.

Price hikes have yet to significantly hinder brands like Louis Vuitton in the China market, although more and more Chinese tourist-shoppers are purchasing their luxury goods in places like Japan, in search of better prices, thanks to weaker currencies. This indicates that Chinese consumers are already showing resistance to frequent price increases, and brand loyalty could further erode if luxury groups are seen as taking advantage of the mainland China market.

This view is reinforced by Jiang Han, a senior researcher at Pangu Think Tank, who cautions that while price increases may reinforce brand prestige, they don’t guarantee improved sales, especially as consumers become more value-conscious. According to Jiang, brands should place greater importance on the bottom line alongside stronger product innovation, quality control, and targeted marketing to engage local consumers.

This post was originally published on this site be sure to check out more of their content.