Receive free Singapore updates

We’ll send you a myFT Daily Digest email rounding up the latest Singapore news every morning.

Banks in Singapore are stepping up scrutiny of customers from a range of countries including China and intensifying efforts to identify the sources of wealth as the city-state reels from a ballooning S$2.4bn (US$1.8bn) money-laundering scandal.

Financial institutions have warned customers and their advisers that the waiting period to open a private banking account has increased from less than one month to three to four, according to wealth advisers, asset managers and private bankers. Some existing accounts are being closed, the people added.

The longer processing times are not an official rule change, the people said, but a reflection of authorities tightening due diligence across the financial sector after a transnational money laundering syndicate was exposed in August.

The institutions are focusing on customers from countries including China, Vanuatu, Turkey, St Kitts and Nevis, Dominica and Cyprus.

“If you have a People’s Republic of China passport, or possess a passport from any of the countries the suspects involved in the probe had, such as Cyprus, Vanuatu or Cambodia, you are getting red-flagged,” said one adviser in private banking.

Singapore police last month arrested and charged 10 people and have seized more than S$2.4bn in assets including luxury properties, gold bars, designer handbags, cash, crypto assets and cars in one of the city-state’s largest-ever money-laundering probes.

The suspects, who have been denied bail, all had Chinese passports. Many were also in possession of additional passports. The probe has widened to include banks, precious metals dealers, real estate agents and golf clubs.

The government has also faced scrutiny about the case and how such lapses happened despite strict anti-money laundering regulations.

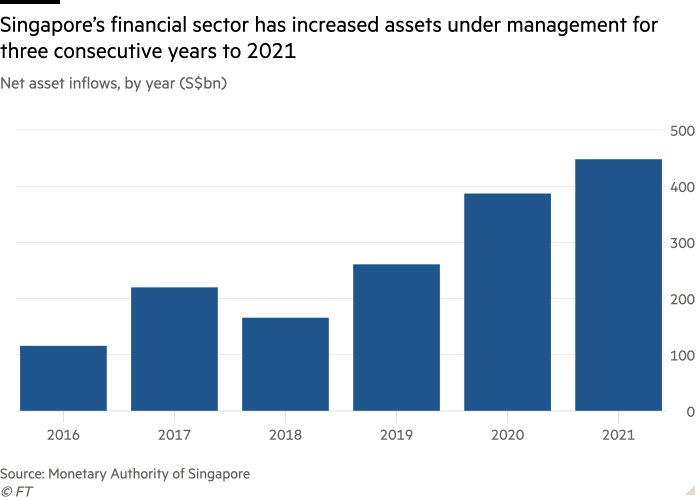

Singapore’s appeal as a stable and neutral wealth hub rose during the coronavirus pandemic, with asset managers attracting S$448bn in net new inflows of funds in 2021, up 16 per cent from the previous year. The number of family offices has jumped from a handful in 2018 to 1,100 at the end of 2022, according to the government.

The Monetary Authority of Singapore, the central bank, sent a note last month to all financial institutions, including asset managers, instructing them to scrutinise dealings with the suspects as well as individuals and companies linked to them, according to two banking executives who saw the notice.

Several banks, including Malaysia’s CIMB and Citigroup’s local subsidiary, have already been asked to provide documents to the investigation. Police have also taken control of millions of dollars held in accounts with Credit Suisse and Bank Julius Baer by one of the suspects.

“MAS takes this case seriously and supervisory engagements with these financial institutions are ongoing,” MAS said in a statement. “Given the attributes and size of their transactions, high net worth individuals are often subjected to more stringent checks by financial institutions.”

The central bank added that it “regularly reaches out” to regulated entities to mitigate risks but does not share those dealings as they are confidential.

“Part of the reason onboarding new customers from certain places is taking longer is because banks are painstakingly going through their records to make sure they have no business with the people or entities on the MAS’s list,” said a director at one wealth manager.

“We have also seen some closing accounts of individuals from some of those jurisdictions,” the person added.

A managing director at another international firm whose clients include family offices from multiple Asian countries said they had been informed that processing times for new accounts could take months as know your customer and other anti-money laundering steps were tightened.

“Most clients are actually fairly happy about this — it provides a sense of security . . . that Singapore is cracking down on any illicit activity,” the person said. “It is a sign of the maturation of Singapore as a financial hub.”

This post was originally published on this site be sure to check out more of their content.