The Federal Trade Commission (“FTC”) made headlines last week when it filed suit to block the proposed $8.5 billion transaction that would see Tapestry Inc. acquire Capri Holdings, a deal that would bring together Coach, Stuart Weitzman, and Kate Spade (which are owned by Tapestry) with Capri’s Michael Kors, Versace, and Jimmy Choo brands. In the administrative complaint that it filed on April 22, the FTC refers to “accessible luxury” at least 68 times – a count that does not include any time the term may have been mentioned in the redacted sections (and there are plenty of those).

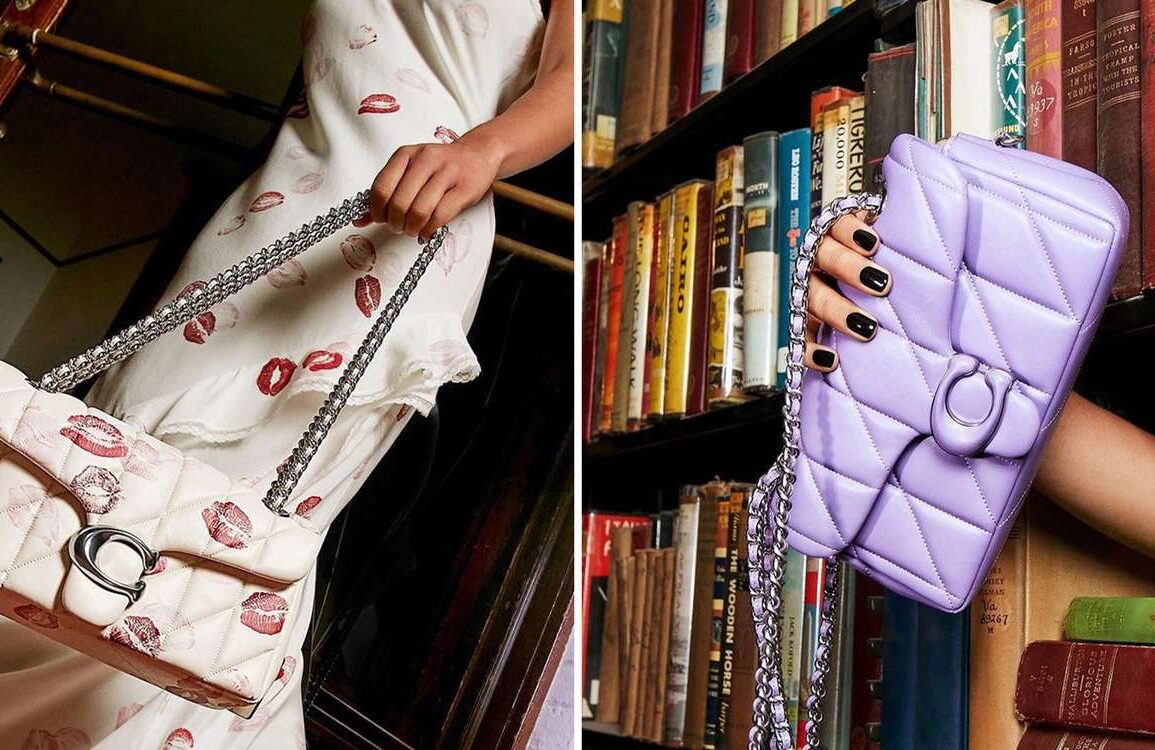

According to the FTC, the deal – if allowed to proceed – would “give Tapestry a dominant share of the ‘accessible luxury’ handbag market,” which it claims was coined by New York-based Tapestry “to describe quality leather and craftsmanship handbags at an affordable price.”

The Lina Khan-led FTC’s focus on “accessible luxury” is significant, as that is what the government agency is defining as the relevant market – i.e., the market in which competition would be stifled should the deal come into fruition. According to the FTC, “By combining three of the top players in the market for ‘accessible luxury’ handbags in the United States – including the top two (Coach and Michael Kors) by far – the Proposed Acquisition will significantly increase concentration and result in a highly concentrated market, making the proposed acquisition presumptively unlawful under controlling caselaw and the Merger Guidelines.”

What the regulator is looking to do here is to frame the market narrowly – and distinguish it from what it calls the “luxury,” “true luxury,” “high-end luxury” or “European luxury” segment – in order to fashion itself a better chance of success of showing that the merger would have anticompetitive effects. Such a narrow focus is critical to the FTC’s case, in light of the size of the players in the “true luxury” segment. After all, even if combined, Tapestry and Capri are no match for giants like LVMH, Kering, etc.

> Case in point: LVMH generated 86.2 billion euros ($92 billion) in revenue in 2023, with the U.S. being one of its largest market (responsible for 25 percent of annual sales), compared to the $6.6 billion in 2023 revenue generated by Tapestry and $5.6 billion for Capri.

The question we have posed from the outset – and the one that counsel for Tapestry and Capri will also certainly raise – is whether the definition of the market proposed by the FTC is the appropriate one, or is it too narrowly construed? The case will likely come down to one that sees the parties arguing over market definition.

This is an excerpt from a Snapshot that was published exclusively for TFL Pro+ subscribers. For access to all of our snapshots and related content, inquire today about how to sign up for a Professional subscription.

This post was originally published on this site be sure to check out more of their content.