This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

The Victorians were dreadful on multiple levels. A Victorian gent who was not busy plundering the colonies was forcing his wife into whalebone corsets or wiping his boots with a street urchin.

But you cannot fault the Victorians on their ambition. William Powell Frith’s 1862 panorama “The Railway Station” depicted a nation going somewhere.

Soon, these toffs, strivers and cads would all be hurtling along at unimaginable speed — 22mph — aboard a spanking new train approved by recent legislation and financed with private capital.

It contrasts with this week’s Conservative party conference. This was an exercise in timidity and backsliding. The problem was illustrated by Prime Minister Rishi Sunak’s decision to axe the Manchester spur of the HS2 rail project.

This will save £30bn from a project whose cost has doubled to £91bn. It will leave a route classified as “low value for money” in place of one offering “low-to-medium” value for money. “That would be a parody of its original purpose,” Lex wrote. Tell us what you think via Lexfeedback@ft.com.

The change of tack will have little impact on the likes of construction groups Kier and Costain as the Manchester leg had not yet been priced into their shares.

The stock of French train maker Alstom collapsed 43 per cent this week. But that was due to the normal grinding delays you get on UK train contracts. So move along there, politics fans, nothing to see.

It says something that Sunak’s big policy announcement was a cancellation. His other main flourish was to ban something, but do it very slowly.

Smoking is obnoxious and tobacco companies have no legitimate purpose. That does not detract from the negative tone of Sunak’s broader non-programme.

Lex’s back-of-a-fag-packet calculations suggest the UK’s population of smokers will fall from 6.4mn now to between 2mn and 2.5mn in 2041. The government will raise the smoking age by one year, every year.

Tobacco companies such as BAT and Imperial have little use for surplus cash except buybacks. At the current rate, they will have bought themselves off the market before they run out of smokers to sell cigarettes to.

The Tory conference came with a side order of climate change complacency. The UK carbon price reveals that investors think the country will miss its CO₂ reduction targets. The price has collapsed to £36 per tonne, less than half that of the EU.

The carbon price should realistically be at £97 per tonne if the UK is going to halve emissions to 50mn tonnes from today’s levels.

To its credit, the British government shows some fitful signs of enthusiasm for nuclear power. It wants to secure financing for the 3.2GW Sizewell C project using the “regulated asset base financing model”.

This offers returns to investors during construction and avoids the backloading of debt costs. Lex endorses this scheme and new nuclear more generally.

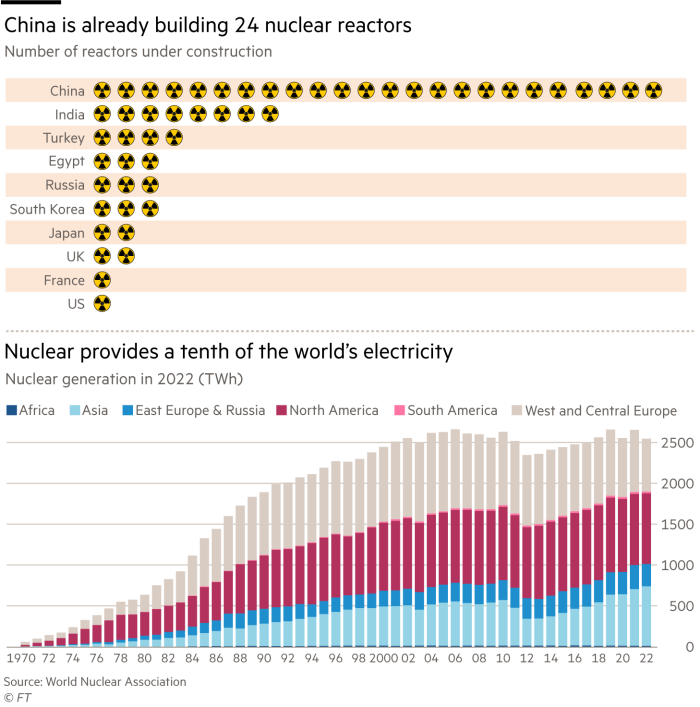

Nuclear energy will be indispensable to the production of baseload power when hydrocarbons are phased out. Installed capacity must triple to 1,160GW by 2050, says the Nuclear Energy Agency. Small reactors proposed by the likes of Rolls-Royce and NuScale have a lot of promise.

Successive governments have shown no appetite whatsoever for tackling the UK’s housing crisis. Affordable modern housing is a social good. But it means building more dwellings. Existing residents, whose votes politicians covet, block development via an underfunded and dysfunctional planning system.

This has created Generation Rent — a cohort of younger people who will never be able to afford their own homes. Increasingly, they cannot afford to rent anywhere either. They may, therefore, have to be rebranded Generation Still Living at Home with Mum and Dad. This certainly applies to my own household.

Lex this week saluted the efforts of so-called build-to-rent businesses such as Grainger, Blackstone, Legal & General and student specialist Unite to ameliorate the latter problem.

Build-to-rent is a good use for patient private capital, just so long as policymakers do not louse up the opportunity. Big companies have the skill, endurance and balance sheets to take on the planners and Nimbys.

Politicians are only indirectly to blame for the stagnation of the London stock market via the chilling effect of Brexit. But guilt should also be apportioned to:

-

corporate governance fundamentalism

-

the slow run-off of final salary pension schemes

-

national distrust of anything new (technology and business propositions included)

-

a preference for finance before enterprise

To paraphrase John Lennon, you may say I’m a declinist, but I’m not the only one.

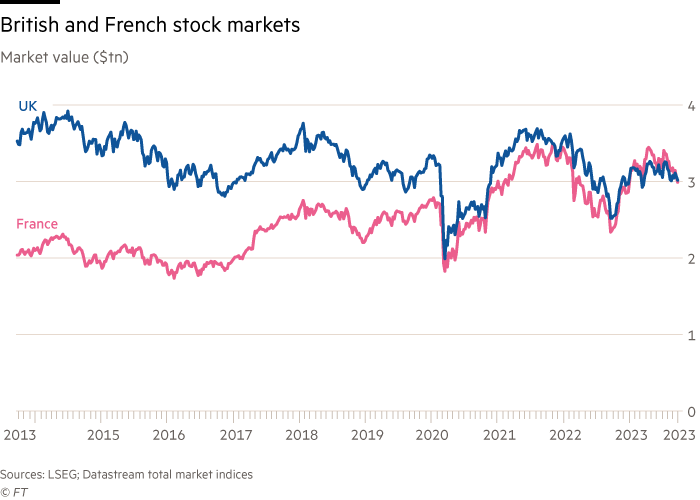

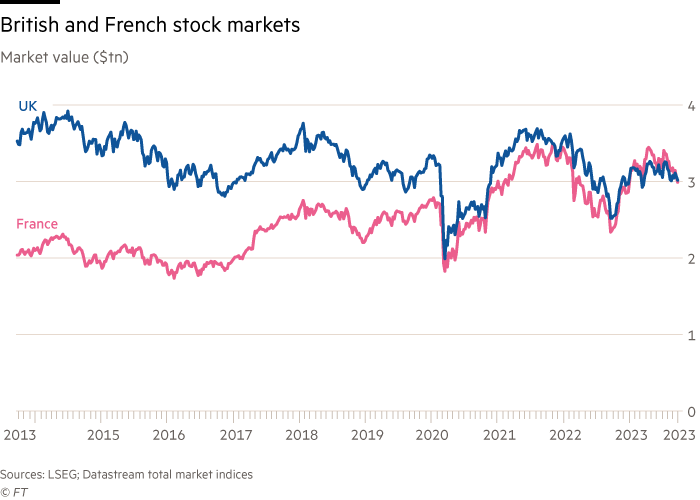

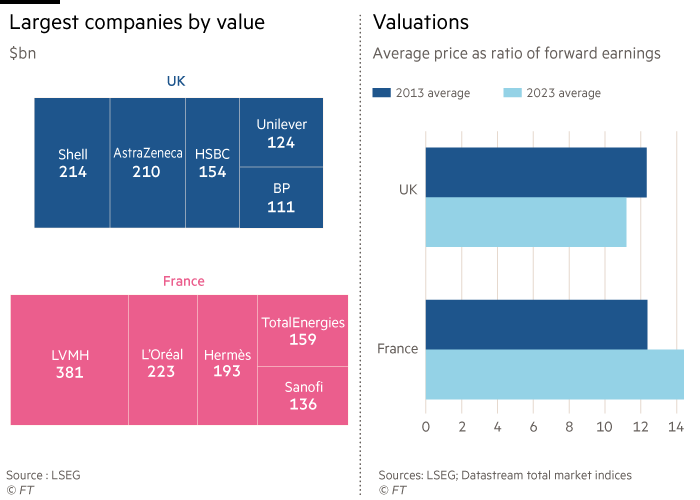

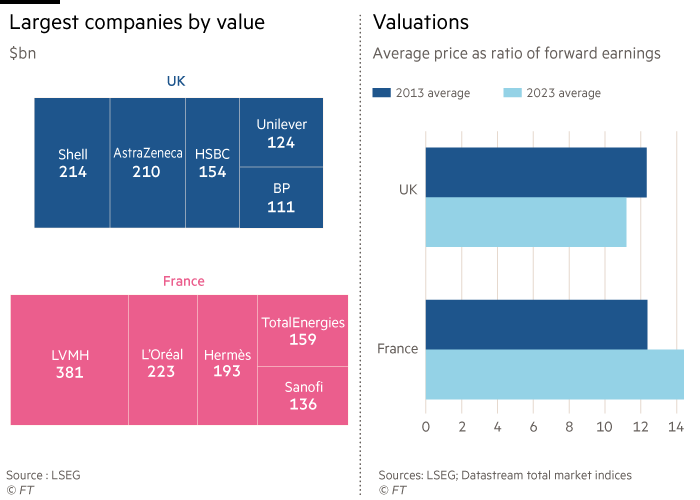

I would like to extract positive vibes from the heritage collection of corporates listed in London. But this is hard work. Their collective value only overtook that of Parisian rivals this week because wealthy Chinese shoppers are buying fewer of the luxury handbags purveyed by Bernard Arnault’s LVMH.

Losing its marbles

Metro Bank has been attempting to create a UK franchise based on a branch network. Almost every other retail banker in the developed world was — and is — desperate to dispense with these costly encumbrances.

Metro doubled down on its contrarianism by adorning its branches with marble accoutrements prescribed by a design company owned by the wife of the bank’s co-founder and former chair Vernon Hill.

The bank is now going down the tubes. That is tough for employees. But it is not a national tragedy, as some media claim. The great strength of capitalism is the scope it provides for experiments. Some of these succeed. Others fail.

Metro has not even been able to make decent returns amid rising interest rates. US Treasury yields hit their highest level since 2007 this week, signalling that investors expect policy rates to follow suit.

That should be good for net interest margins. But investors are anxious about the scale of unrealised losses on investments that US banks may reveal with third-quarter earnings in a few days’ time.

These may be more of a problem for regional banks than the likes of JPMorgan Chase.

Mainstream banking franchises are immensely robust. New entrants, such as UK neobanks Revolut, Monzo and Starling, have a better chance of becoming niche operators than disrupters.

Things I have enjoyed this week

Robert Shrimsley’s excellent column on Rishi Sunak confirmed my view that this caretaker prime minister has a strategy but no substance. I also liked Ludovic Hunter-Tilney’s interview with veteran reggae DJ and filmmaker Don Letts.

Beyond the FT, I enjoyed Hans Holbein’s mordantly humorous woodcut series The Dance of Death, via a Penguin Classics paperback.

In the end, Old Bony comes for everyone, from knight to pauper, as Ingmar Bergman’s The Seventh Seal also showed. A smart dissection of the movie featured as the thousandth episode of Radio Four’s In Our Time discussion programme, which I listened to on catch-up.

This is intelligent, grown-up broadcasting. It has survived the dumbing down of the BBC thanks to the popularity and longevity of presenter Melvyn Bragg.

Enjoy your weekend, whatever you are reading or listening to.

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

This post was originally published on this site be sure to check out more of their content.