There is no sales tax on menstrual products in Ohio, but the “pink tax” didn’t disappear.

The pink tax originated as a phrase describing the tax on menstrual hygiene products, such as sanitary pads and tampons. If something is deemed as a necessity, it is not taxed, economics professor Curtis Lockwood Reynolds said. Examples of products exempted from tax in the state of Ohio include groceries, prescription medicine, some medical supplies, gas and more, but there is still gender-based pricing discrimination.

“If you collect tax on these [necessities] it sort of hits lower income people harder,” Reynolds said.

In April of 2020, the sales tax on menstrual hygiene products was eliminated through Senate Bill 26. State Rep. Brigid Kelly released a statement when the provision was announced.

“Individuals in our state who have periods will no longer have to pay the sales tax on these medically necessary products,” Kelly said. “This repeal helps to ensure that folks are better able to lead a healthful life, to regularly attend school, work or personal events and to fully participate in their communities as they choose. No one should have to struggle financially because of their period.”

Since then, when people speak about the pink tax, they are typically referring to gender-based pricing. This is when a product comes in two variations, one marketed toward women and the other toward men, with the women’s product version being more expensive, according to Reynolds.

“For some reason, on average, women are willing to pay more to get what’s essentially a version of the product marketed towards women, which typically means a different color,” Reynolds said. “You know, the classic one being pink.”

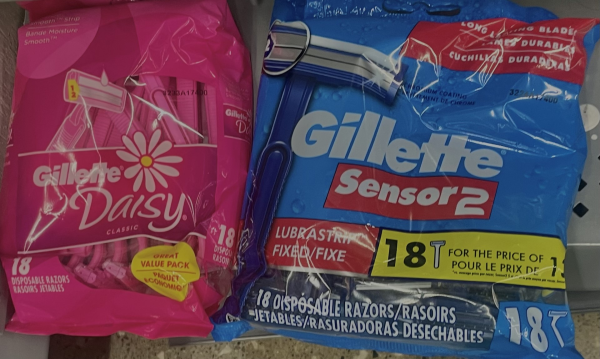

As an example, Reynolds used the razor as an example. Many razor brands make a version marketed towards women, and a version marketed towards men. In many stores, they get their own separate sections. For razors marketed towards women, they are usually pink and may have “rounded-edges” or other features suited towards a woman’s shaving needs. The men’s razors will typically look like they’re metal, black or blue.

The brand Gillette sells two variations, sold at the same price at Walmart, in separate sections of the store for their 18-count razors. One is a pink package, called “Gillette Daisy” and its value pack feature is the “Moisture Smooth Strip.” The other is a blue package titled “Gillette Sensor 2,” highlighting the “Lubrastrip.”

Walmart shopper Arianna Garver described her knowledge of the pink tax as a tax on products made for women.

“I buy men’s razors instead of women’s razors every time, because they’re cheaper,” Garver said.

Reynolds discussed the effect of gender-norms and social conditioning in regards to gender-based pricing and how consumers choose what to buy.

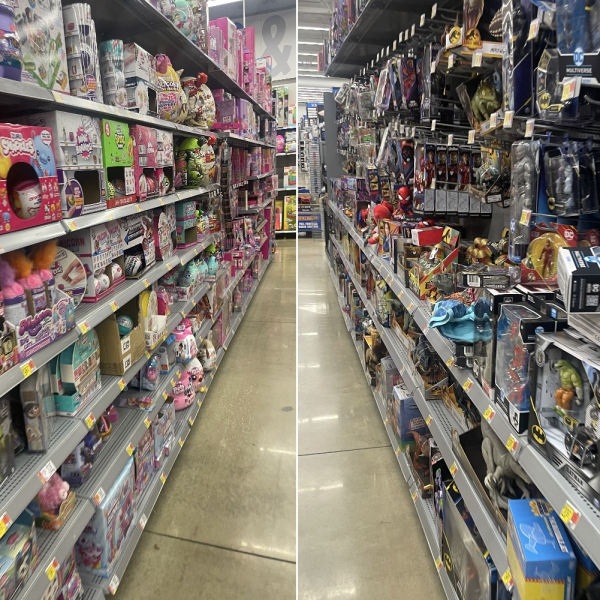

“Starting very early on, literally, people are doing those gender reveal parties, pink or blue. The baby isn’t even born yet. And we’re doing the pink and blue,” Reynolds said. “And then that starts to get pushed further. Girls play with dolls and boys play with trucks. That’s not even necessarily true.”

Although there is no sign in stores saying “women shop here,” and “men shop here,” the pink and blue color system gives a suggestion on where boys and girls should go.

“There’s the aisles with all the pink and purple, and it’s like, here’s this aisle where all the girls are supposed to go. And here’s this aisle where all the boys are supposed to go,” Reynolds said. “And even for people who don’t necessarily care, they follow their friends or their parents, and it just starts to become ingrained that this is what you’re supposed to look at.”

Economics professor Kathryn Wilson explains the pink tax as products that are marketed towards women having a higher price than either gender-neutral or products that are targeted towards men.

“Particularly as an economist, I would think of the pink tax is when those higher prices don’t reflect higher costs of producing the product,” Wilson said. “It’s not because it costs more, but yet women still have to pay more.”

The pink tax goes past hygiene products. Wilson said services, such as haircuts and dry cleaning, can also fall under the pink tax when priced differently by gender.

“Often, it’s a different price to get a women’s button down shirt dry cleaned and a men’s button down shirt dry cleaned,” Wilson said. “Now, if it’s because the women’s button down shirt requires more labor or something to clean, then that’s one thing, but just to have it be as a blanket price, then that would fall under the pink tax.”

Not every price difference points straight at gender-based price discrimination. If one product costs more to make because it is manufactured with different materials, making the production more expensive and causing the retail price to be higher, then that doesn’t reflect the pink tax, Wilson said.

Another layer to different pricing comes from tariffs, which is a tax on U.S imports. A lot of our tariffs are higher on women marketed products than those marketed toward men, Wilson said.

“Some of the pink tax actually comes because a lot of what we buy gets imported from overseas and when we import products, a lot of times it’s just a tariff on imports,” Wilson said.

Audrey Trevarthan is digital assistant. Contact her at [email protected].

This post was originally published on this site be sure to check out more of their content.