A women-owned, Los Angeles-based women’s apparel manufacturing company recently sought funding to meet building demand. They chose Republic Business Credit to support their growth and Republic provided a $1,000,000 traditional factoring facility to double their sales in the first half of 2023.

“We are excited to have a factoring partner that can grow with our brand and help us to share our fashion line with more consumers,” said the apparel company’s CEO.

“Our factoring, credit protection and collections products are tailor-made for growing brands,” said Republic Senior Vice President Business, Tae Chung. “We are proud to support so many great brands across the women’s apparel industry, especially those that are woman-owned.”

According to Market Watch, the Streetwear Market, “is expected to expand at a [compound annual growth rate] of 3.52% during the forecast period, reaching USD 230877.25 million by 2028.”

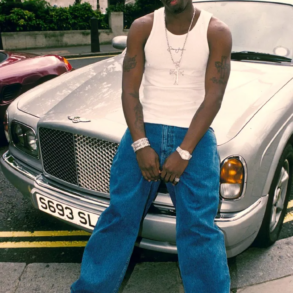

Meeting the rise in demand for these products, the company specializes in selling a variety of women’s streetwear products, including t-shirts, sweatshirts and joggers. The company is focused on merging luxury with street style, providing comfort to its customers without sacrificing fashion.

“As a promising area of growth in the fashion industry, it is an exciting time to invest in streetwear,” said Republic President, Robert Meyers. “It is a great opportunity to support a women-owned business in the growing, popular industry of women’s fashion.”

The company was founded in 2012 and sells women’s clothing through their own line and private labels. It currently employs 15 people, and its top customers are Fashion Nova and Windsor Fashions.

“It is encouraging to see rapid growth in the US-based apparel manufacturing industry,” said Republic Chief Operating Officer, Matthew Begley. “We are excited to add this company to our growing portfolio of apparel companies we have helped to grow through factoring and lending solutions.”