EXCLUSIVE: From Banksy paintings, a fine wine collection and a 1st edition of Spider-Man comic: Luxury pawnbroker reveals surge in unusual items being traded in by rising numbers of wealthy clients as cost-of-living crisis sparks ‘record levels’

Wealthy Londoners are pawning everything from Banksy paintings and fine wine collections to help make ends meet as the cost-of-living crisis continues to batter family finances, a top pawnbroker has revealed.

Jim Tannahill, managing director of luxury London pawnbrokers Sutton and Robertsons, which has outlets in Fleet Street, Victoria and Kensington, said more people were turning to using his firm to trade in treasured valuables.

The veteran pawnbroker said the cost-of-living crisis had caused business to boom to its biggest levels in his 40-year career as more desperate Britons pawn off their heirlooms to make ends meet.

But he warned there is ‘more pain to come’ as the financial crisis continues to batter budgets, with even traditionally more wealthy central London families now turning to pawning in beloved keepsakes.

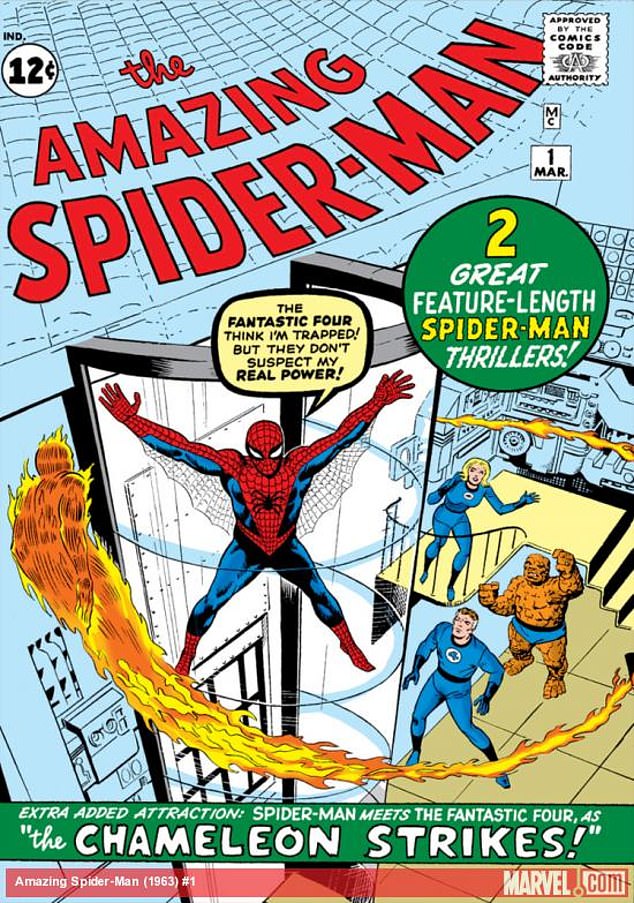

Recently, he has seen everything from a Banksy’s Girl with Balloon painting and Aston Martin to a 1st edition Amazing Spider-Man comic, luxury handbags and the usual staples of high-end jewellery and gold being pawned.

Have you been forced to pawn in a beloved family heirloom to make ends meet? Email tom.cotterill@mailonline to tell your story.

Speaking to MailOnline, he said: ‘We have seen an uptick in the quirky items – handbags, we have loaned money against money to these Berkin bags and Chanel bags. There’s some fine art, too. We did a loan on a Banksy and one on a Picasso which is unusual.

‘We have also taken some classic cars. We had an old Aston Martin not that long ago. We loaned quite a bit of money on some fine wine. That’s unusual. We just recently loaned a few thousand on some comics. One being a number one Spider-Man edition.’

It comes as figures this week revealed that demand for pawnbroking had hit ‘record levels’ in Britain due

Demand for pawnbroking has hit ‘record levels’ in Britain because of high inflation, according to the boss of the UK’s biggest operator.

H&T Group said its pre-tax profit had ballooned 31 per cent to 8.8million in the first half of the year compared with 2022.

And the company’s ‘pledge book’ – which covers loans against customer assets like jewellery, watches and other high-value goods – was worth a staggering £114.6million in June, up from £85.1million at the same time in 2022.

Chris Gillespie, the firm’s chief executive, said demand had reached ‘record levels’ partly because of a lack of alternatives. ‘Supply of small-sum credit is constrained now in a way it hasn’t been for many years,’ he said.

‘If you only want and need to borrow £200, your options are very limited,’ he told the Financial Times.

He added that ‘to a degree’ the rise in demand for pawnbroking was also because of the high cost of living.

Pawnbroker Ramsdens has also seen its takings soar, with pre-tax profit in the six months to March rising 68 per cent to £3.7million.

Meanwhile, its loan book’s value increase 29 per cent to £9.7million over the same period, while net assets increased by £5.4million to £43million.

‘There is a lack of small-sum, short-term credit,’ said chief executive Peter Kenyon. ‘Home collected credit has been decimated, payday lending has been decimated — so the customer has fewer options.’

Have you been forced to pawn in a beloved family heirloom to make ends meet? Email tom.cotterill@mailonline to tell your story.

This post was originally published on this site be sure to check out more of their content.