LONDON — Southeast Asian nations such as Vietnam, Thailand, Malaysia and the Philippines that have benefited from China’s returning tourists and a booming middle-class population are likely to be the upcoming hot spots for luxury retail in the second half of 2023 and beyond.

Data from Statista showed that revenue in the Vietnamese luxury goods market is inching toward $1 billion in 2023, while the Thai luxury market will amount to $1.94 billion by the end of this year, growing annually by 3.2 percent and 5.70 percent, respectively.

According to Savills, the opening of new luxury hotels such as Four Seasons, Fairmont, Waldorf Astoria and Ritz Carlton in Hanoi, the capital of Vietnam, will be a great plus in terms of attracting luxury brands.

The leasing agent added that in Hanoi, brands want frontages on main streets in the center with prime locations, large leasable areas and proximity to affluent customers. Hoan Kiem District is preferred. The city was the only major retail market in Southeast Asia that saw rentals going up between 2019 and 2021.

In Bangkok, the capital of Thailand, where the return of Chinese shoppers is making “a big impact,” according to Savills, a slew of high-end retail projects, such as Dusit Central Park and One Bangkok, are in the pipeline to fuel luxury retail growth, with more than 5 million square feet of prime retail space added this year.

Runway Vietnam store at Diamond Plaza is split into two areas, with one catering to “women who value creative and original elegance,” and the other dedicated to younger generation consumers with a more urban and experimental brand mix.

Courtesy of Runway Vietnam/P.Photography

Anh Tran, founder of Runway Vietnam, noted that the local luxury retail industry has seen improved performance as the result of the significant rebound of tourism, especially in Thailand, Malaysia and Singapore.

Founded in 2008, Runway Vietnam is a leading luxury retail concept with a recently opened 7,535-square-foot multibrand store at Diamond Plaza in Ho Chi Minh City. It is registered under GlobalLink Co. Ltd., the monobrand boutique operating partner for a slew of major luxury brands in Vietnam. Besides the Diamond Plaza location, Runway Vietnam has two other stores, in Ho Chi Minh City and in Hanoi.

Tran noted that high-end malls in Bangkok such as Siam Paragon and IconSiam have seen a stream of affluent customers from Malaysia, China and Russia buying luxury goods. As a result, average sales from international luxury brands at these shopping malls were reported to surge by 50 percent. For Malaysia, due to religious ties, high-spending Middle Eastern tourists are fueling the rebound.

With regard to her home country Vietnam, Tran observed that the country’s tourism will take longer to recover. Also, since the economy strongly depends on production for export, local spending on luxury goods will remain low.

Anh Tran, founder of Runway Vietnam, middle, with guests at the opening of the Runway Vietnam store at Diamond Plaza.

Courtesy of Runway Vietnam

“The second half of the year will be considerably more difficult, since fashion retailers are currently in survival mode, focusing on cutting stock and minimizing loss. However, if our government’s new policy to improve the economy, particularly tourism, is successful, we may have a better chance at the end of the year when we can welcome more tourists,” Tran added.

Tran also believes that by developing a strong luxury retail sector, Vietnam can attract high-spending tourists and boost its overall economy.

“This can be achieved by attracting renowned luxury brands and creating upscale shopping experiences that cater to the preferences of affluent travelers. Additionally, investing in infrastructure and improving transportation networks would make it easier for tourists to access luxury retail destinations, further driving economic growth in the country,” she said.

People queue to enter a store of luxury goods brand Hermès in Bangkok.

AFP via Getty Images

A key competitive edge for the Southeast Asian luxury retail market is its lower rents compared to major luxury retail hubs like Singapore, Hong Kong, Shanghai or Tokyo.

It’s attractive for global investors to open new stores in the region, according to Aika Alemi, a consultant, coach, and artist who works closely with some of the largest luxury retailers in Southeast and Central Asia.

However, a major challenge remains as the wholesale prices offered to Southeast Asia distributors are higher than those offered to their European or American peers, noted Alemi.

“That in itself, the delivery and import costs aside, has a snowball effect on retail prices, which add up to be significantly higher than the online prices on the international marketplaces. It discourages the local distributors, cannibalizes their margins, erodes their market share, and repels the existing and new clients,” she added.

Tran believes that international brands should consider building strong relationships with local distributors to help navigate any potential challenges and ensure a smooth entry into the local market.

“It is understandable that brands want to secure margins, but success for both parties is possible if local distributors are treated equally as European distributors, for example,” Tran said.

Such an environment has also made it harder for emerging local talents to get support, although several have prevailed, such as Gia Studio, Annie & Lori, Monica Ivena, Alia Bastamam and Senada Theory. These brands “keep taking the local national codes to the global celebrities and boutiques,” Alemi said.

Bea Valdes, editor in chief of Vogue Philippines

Courtesy of Vogue Philippines

Thanks to advocates like Bea Valdes, editor in chief of Vogue Philippines, which has been published by Mega Global Licensing Inc. under a license agreement with Condé Nast since August 2022, a cohort of Southeast Asian designers is gaining global attention.

For its launch issue, the title spotlighted local designer labels such as Ha. Mu, Jinggoy Buensuceso, Chris Nick, Leby Le Morìa, Gihay, Abdul Gaffar, Ivarluski Aseron and more.

In an interview with WWD, Valdes said Carl Jan Cruz is a young designer that the locals have been watching.

“His clothes have redefined designer dressing, by elevating casual home wear into his signature cool and crafted. ‘Contemporary, Filipino, international and inter-barangay [inter-village] is how CJ describes his textured aesthetic when Vogue Philippines interviewed him early this year,” Valdes said.

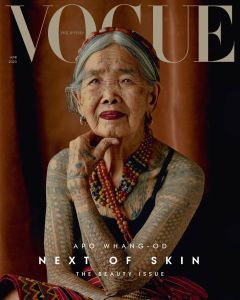

Vogue Philippines earlier this year made global headlines for putting Apo Maria “Whang Od” Oggay, the 106-year-old tattoo artist on its April issue cover.

Courtesy of Vogue Philippines

Compared to the Chinese, Japanese or South Korean luxury retail landscapes, which are more or less in sync with global trends, Alemi noted that the spending habits in Southeast Asia are more influenced by the local cultural heritage. Hot and humid climates dictate the choice of light fabrics, loose but still dressy shapes, conservative silhouettes and basic or neutral colors.

In terms of regional differences, Alemi observed that “Vietnam, Laos and Cambodia are framed by their post-communist heritage, which may show itself in the well-educated customer preferring safe, rigid and formulaic styles. Muslim influence in Indonesia and Malaysia gave way to their own version of quiet luxury — modest fashion with hijabs, abayas, burkas of subdued hues, and also a whole separate world of what women wear in private settings when hijabs are off.

“In Thailand, people seem more keen to experiment, fuse lines between genders, and embrace conceptual and avant-garde in daily wear as the country has always been part of the free economy and liberal values free from religious, like in Malaysia and Indonesia, or ideological barriers like in Vietnam,” she added.

According to Valdes, the luxury and fashion consumers in the Philippines “now include a healthy balance of both male and female consumers. It has evolved into a more well-rounded retail ecosystem in the last decade.”

To cater to the title’s “multigenerational, more discerning” readers, Valdes said the magazine often focuses on a brand’s or designer’s creative journey as “we feel the Philippines audience is keenly interested in the craft and the history behind the pieces they offer.”

“As multigenerational relationships are important to us; stories that refer to family connections are popular. Our readers are also interested in identity, spanning cultural, beauty and gender issues.…We aim to cultivate the fashion and luxury audience through broad strokes of options, not just in terms of topics or merchandise, but in changing consumer mindsets as well. We have also tried to contextualize the designer pieces by showcasing them on Filipino creatives or within editorials that celebrate certain Filipino values, such as family ties, or inclusivity,” Valdes added.

Meanwhile, Tran pointed out that despite being categorized in the same region, these markets are different in their level of income.

“Thailand and Malaysia are economically wealthier than Vietnam and the Philippines and thus these countries have different customer preferences. While in richer economies people may be interested more in bags and shoes, in Vietnam, clothing and accessories play an equally important part in consumers,” Tran added.

A woman walks past as a girl poses for photographs outside a Louis Vuitton store along a street in Hanoi, Vietnam.

AFP via Getty Images

Tran noted that there are only a few main players in the sector, with GlobalLink being one of them. Its retail partners include Alexander McQueen, Balenciaga, Celine, Givenchy, The Row, Saint Laurent and Loewe.

Other key players at the same level include Thailand’s PP Group, the Mall Group, Siam Piwat, as well as the Valiram Group, and the Melium Group from Malaysia, according to Tran.

Retailers such as Rustan’s, Como, Adora, Homme Et Femme, Moressi, Runway, IPPG and TamSon are key players in the market as well, Alemi said.

Alemi added that e-tailers like Club 21, Black Bow, Cul-De-Sac, Fashion Valet, Jade, Siwilai and Bobobobo are very active and popular with younger generations in Southeast Asia.

In general, Alemi finds the Southeast Asian luxury retail market “more corporate, commercial, cautious and less experimental, eclectic and emotional in everything from the buying mix to visual merchandising, styling, store design to marketing and social media.”

“It seems it has to do with the cultural background, physical distance and the idea that these territories at the far tip of Asia are tucked away from the world and despite the ubiquitous internet are somewhat isolated from rebellious, iconoclastic, hectic, stressful and agitating influences of the West and East,” she added.

This post was originally published on this site be sure to check out more of their content.